Monday of last week, Sainsbury’s share price surged to a seven-year high as speculation of an imminent approach reached fever pitch. Fast forward six trading days, these gains are close to being wiped out as investors adjust to the reality that the share price had gotten way ahead of itself.

Following UK supermarket chains seeing a spate of takeover activity, it seemed inevitable that J Sainsbury plc (LON: SBRY) would attract the attention of private equity. Whilst bid rumours have been doing the rounds for some time, conformation came last weekend when the Sunday Times reported the US Investing giant Apollo Global was readying a bid.

Sainsbury’s gapped higher the next day, opening at 302p before extending to 342p, its highest price since 2014. According to reports, the spike higher forced several high-profile hedge funds, including Dan Loeb’s, Third Point, scrambling to cover short positions.

However, in the three days that followed, SBRY dropped 7% to 320p. Furthermore, a report published by UBS suggests Apollo’s interest is ‘exploratory’, and the bank maintained a neutral stance and 300p price target. As a result, SBRY has continued to see selling this week, dropping a further 5% to 304p. Not to mention, the share price has reversed last week’s breakout.

SBRY Technical Analysis

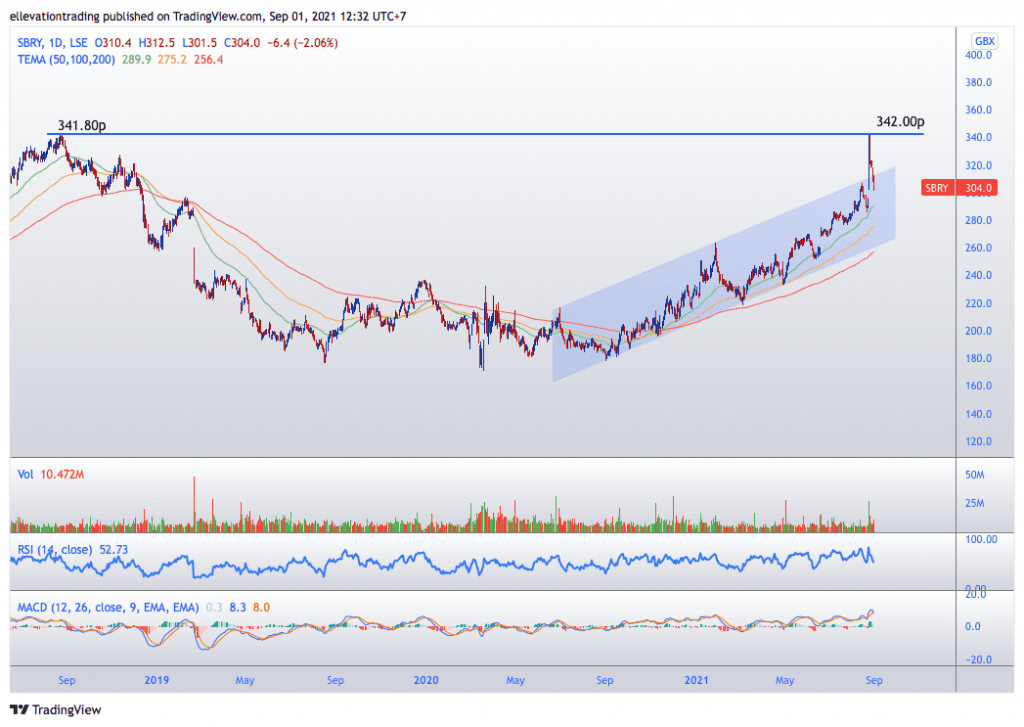

The daily chart shows SBRY has fallen below the top end of a parallel trading channel at 312p. This should lead to follow-through selling, targeting the 50-day moving average at 289.9p. However, considering the short-covering, SBRY could go even lower.

A steeper correction would target the 100 DMA at 275p, and following that, the lower end of the trend channel at 260p. For now, the path of least resistance is lower and that will remain the case as long as SBRY stays below 342p. However, until a bid either materialises or is dismissed the share price could remain volatile and unpredictable. And on that basis, investors should exercise caution.

Sainsbury’s Share price Chart

For more market insights, follow Elliott on Twitter.