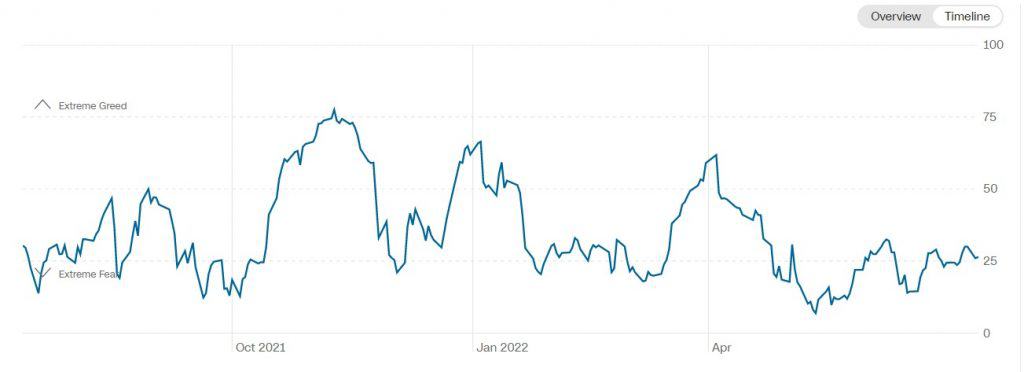

The fear and greed index tilted upwards as the earnings season kicks off. The index rose to 26 on Tuesday from the previous day’s close of 25. It remains in the fear zone as investors wait for the latest American inflation data and bank earnings. The Russell 200 index, which tracks small-cap stocks, declined to $1,729, which is about 30% below the YTD high. Other indices like the Dow Jones and Nasdaq 100 continued to recoil.

Fear and greed index performance

Investors are getting significantly fearful these days as recession and high-interest rate risks remain. The closely-watched fear and greed index has remained below 50 since April of this year. This performance has coincided with the weak performance of American equities. Stocks in virtually all industries have all crashed hard as investors worry about margins and growth.

All indices that make up the fear and greed index have moved to either the fear or extreme fear levels. For example, market momentum, which is measured by the moving average, has moved to the extreme fear level. It means that the S&P 500 index is significantly below the 125-day moving average. Similarly, the stock price breadth, safe-haven demand, and junk bond demand have all crashed.

The next key catalyst for the fear and greed index will be the earnings season. On Tuesday, PepsiCo published results that did better than expected. The firm warned that inflation was still a thorn in the flesh. Looking ahead, the next companies that will publish on Wednesday are Fastenal, Delta Air Lines, and Progressive. They will be followed by companies like JP Morgan, Morgan Stanley, and Wells Fargo.

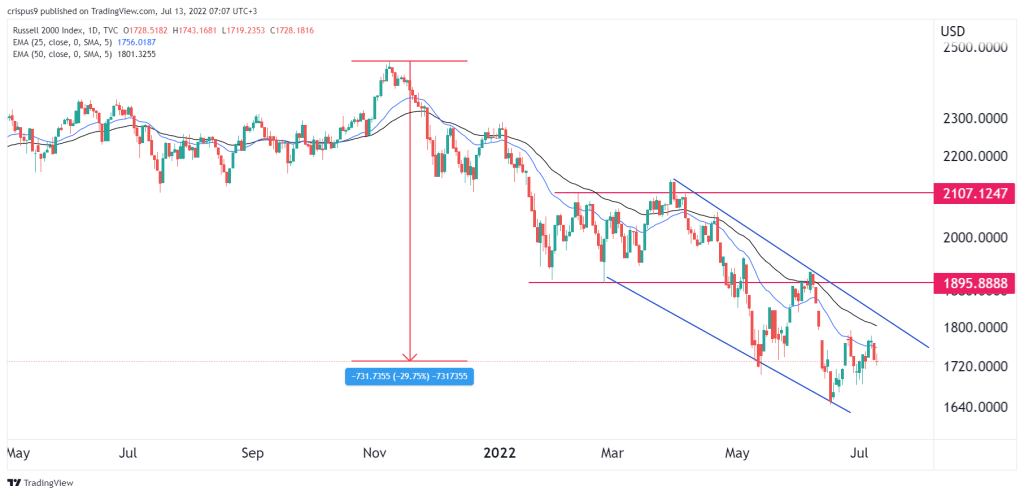

Russell 2000 forecast

The daily chart shows that the small-cap-heavy Russell 2000 index has been in a strong bearish trend in the past few months. It has fallen by over 29% from its highest point this year. Along the way, it has dropped below the important level at $1,895, which was the lowest point in February. At the same time, the index has fallen below the 25-day and 50-day moving averages.

The Russell index is also between the descending channel shown in blue. Therefore, I suspect that it will continue falling as the earnings season starts. If this happens, the next key support to watch will be at $1,642. A move above the resistance at $1,800 will invalidate the bearish view. The index’s recovery will be confirmed when the fear and greed index rises above 50.