The Deliveroo share price is under pressure with the economic reopening in the UK and a return to restaurant dining. Recent expectations of a spike in winter virus cases are also fading with recent data and a four-day drop in cases.

Professor John Edmunds, an epidemiologist with SAGE, said the spike in infections over the last few months was driven by ‘huge numbers of cases’ in the young. Health officials said as many as one in 12 children in England had the virus last week. But, any surge in infections “will eventually lead to high levels of immunity in children” which will see cases plateau and then fall, Edmunds said. He added that it “may be that we’re achieving that now”.

Cases have fallen for four days in a row, whilst modelling from SAGE has said infections could slump to the 5,000 mark over the coming months.

No return to lockdowns would hit the growth trajectory of Deliveroo shares and investors are rethinking a 500bn market cap. However, Deliveroo bulls will appreciate the pull back in shares as the company seeks to expand globally. Deliveroo Hop is looking to move outside of London, and into new markets including Italy, France and Hong Kong, according to job posts on the Deliveroo website.

The delivery app business is seeing increased growth from micro fulfillment centre deals, such as the one between WM Morrison and Deliveroo, which provides a 10 minute service.

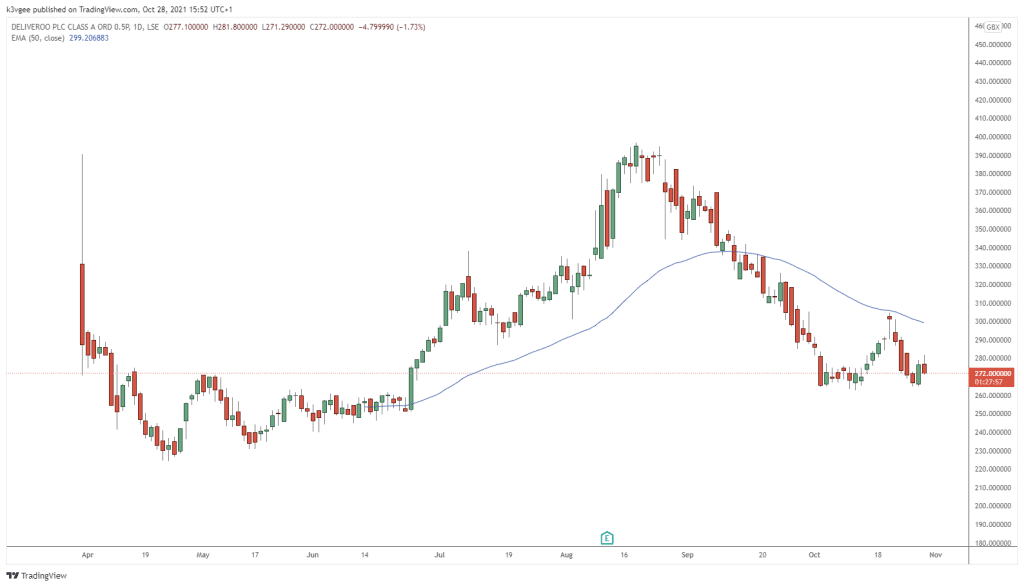

Deliveroo Share Price Analysis

Th ROO share price began a strong rally in June from the 250p level to highs of over 400p. The price has since faded and is testing support levels around the 270p area. A move lower could see further losses in ROO with the next strong support being at 220p. Resistance for a rebound would be at the 300p level.

Roo Price Chart (Daily)