The Rolls Royce share price is a tad lower this Monday as the bulls push the price action up from the opening bearish gap in an attempt to register a 4th consecutive winning session. The Rolls Royce share price continues to enjoy tailwind support after a slew of positive news triggers from last week.

The company is basking in the award of a significant carbon capture funding grant from the UK government. Rolls Royce will receive £3 million from the UK government to construct a demonstrator DAC system in Derby. The project is due for completion in 2023 and will see a removal of more than 100 tonnes of CO2 emissions annually. In addition, a ramp-up of the capacity of this plant to a full version will upgrade its CO2 clearance capacity to one million tonnes.

Rolls Royce makes engines for aircraft, with revenue from this source coming from flight hours notched. The company’s aviation business is also getting a boost from the faster-than-expected recovery of the widebody aircraft market. According to Bloomberg, Airbus is in talks with Rolls Royce regarding future manufacture and pricing.

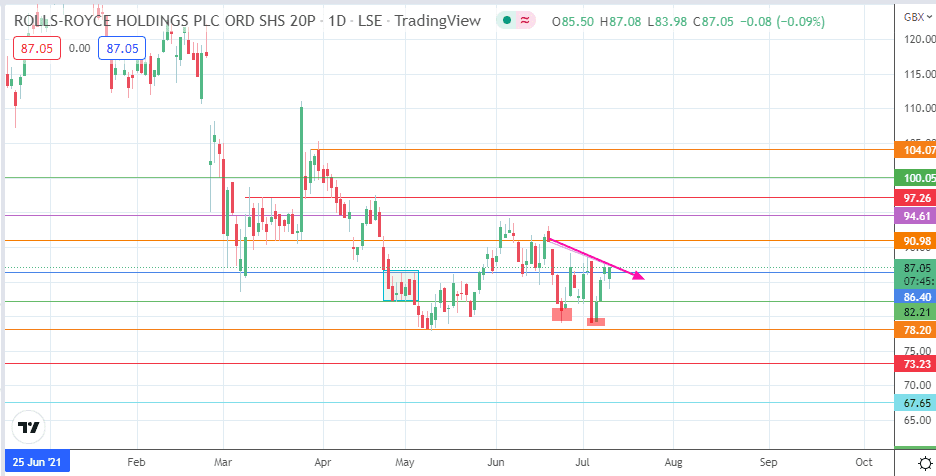

The Rolls Royce share price action is evolving into a double bottom pattern, with the bulls needing to force a break of the neckline resistance at 86.40 to complete the pattern and signal the continuation of the recovery move.

Rolls Royce Share Price Forecast

The emerging double bottom pattern requires a neckline break at the 86.40 resistance line (29 April and 29 June highs) to attain confirmation. This confirmation brings up 94.61 (4 March 2022 high) as the completion point of the pattern’s measured move. However, 90.98 is the barrier that needs to give way for this to happen. Therefore, a further advance targets 100.05 (28 February low), leaving 104.07 as the additional harvest point for the bulls.

Conversely, rejection of the attempted break at 86.40 temporarily invalidates the upside potential, allowing the bears to push for contact with 82.21 (3 May and 7 June lows). Further weakness will lead to a breakdown of 82.21, targeting 78.20 (10 May low). Additional harvest points for the bears are found at 73.23 (3 August 2020 low) and 67.65 (6 November 2020 low).

Rolls Royce: Daily Chart