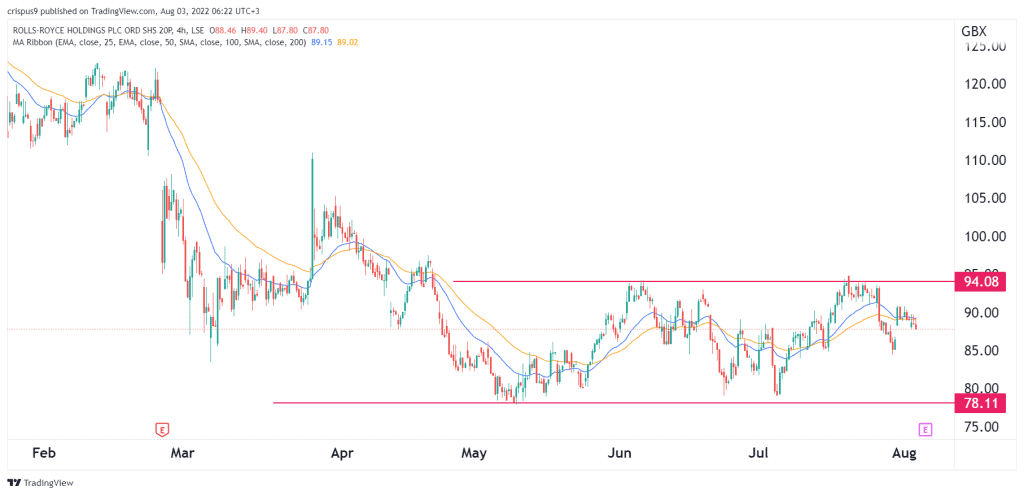

Rolls-Royce share price has pulled back in the past few days as the market waits for the upcoming first-half results scheduled for Thursday. The RR stock is trading at 87.80p, which is about 7.45% below the highest point in July this year. The price is about 12% above the lowest level this year.

Rolls Royce earnings ahead

Rolls-Royce Holdings will publish its first-half results on Thursday. Analysts expect that the company had a mixed performance in the first half. For example, they believe that the company’s revenue rose because of the strong recovery of the aviation industry. At the same time, analysts expect that the company’s profitability suffered as the cost of key commodities like titanium, steel, and aluminum rose.

Analysts believe that the company’s business will continue improving in the next few years. For example, they expect that its group revenue will rise from £11.6 billion in FY22 to £12,637 billion in 2023. It will then rise sharply to over £14 billion in 2024. In the same period, Rolls-Royce will see its free cash flow rise from £134 million to £811 million.

Another catalyst for the Rolls-Royce share price is the overall recovery of the aviation sector. Many airlines have recently published strong results and indicated that demand remained strong in Q2. At the same time, manufacturers like Boeing and Airbus have reported strong results. As a result, analysts expect that all this will translate to swifter recovery.

Meanwhile, the cost of doing business is expected to drop slightly in the second half of the year. That’s because most of the top commodities that are used in engine manufacturing have declined in the past few months. These include commodities like titanium and steel.

Finally, the other business arms of Rolls-Royce like power and defense are expected to do well as countries readjust to the new normal in Ukraine. Countries, especially those in Europe, have reported that they will soon boost their military spending, which will hurt their recovery. Another catalyst is that the company recently unveiled the next CEO who will take over from Warren East.

Rolls-Royce share price prediction

The four-hour chart shows that the Rolls Royce share price has been in a strong bearish trend in the past few days. It has managed to move from last month’s high of 95p to the current level of 87.80p. The stock has moved slightly below the 25-day and 50-day moving averages. It is also between the channel at 95p and 78.11p.

Therefore, there is a possibility that the stock will gap higher after earnings. If this happens, the next key resistance level to watch will be at 95p. A drop below the support level at 85p will invalidate the bullish view.