The Rolls Royce share price is one of the big winners of the anticipated relaxation of COVID-19 travel rules in the UK. The jet engine maker’s stock has seen the second day of advance, gaining 3.31% to come in second on the FTSE 100 gainers’ chart.

Rolls Royce operates a form of “pay-as-you-go” arrangement in which revenue from its jet engines are paid for according to the number of hours they log. An increase in flight hours, especially over long-haul international routes, could provide the needed revenue to allow its aviation division to recover from the pandemic hit of 2020.

Meanwhile, Rolls Royce continues to advance its development of improved engine systems, announcing that it is developing a digital system to enhance the refuelling efficiency of the US Air Force as a cost-saving improvement. This development follows the award of a contract to develop a software system to this end by the US Transport Command.

Rolls Royce Share Price Outlook

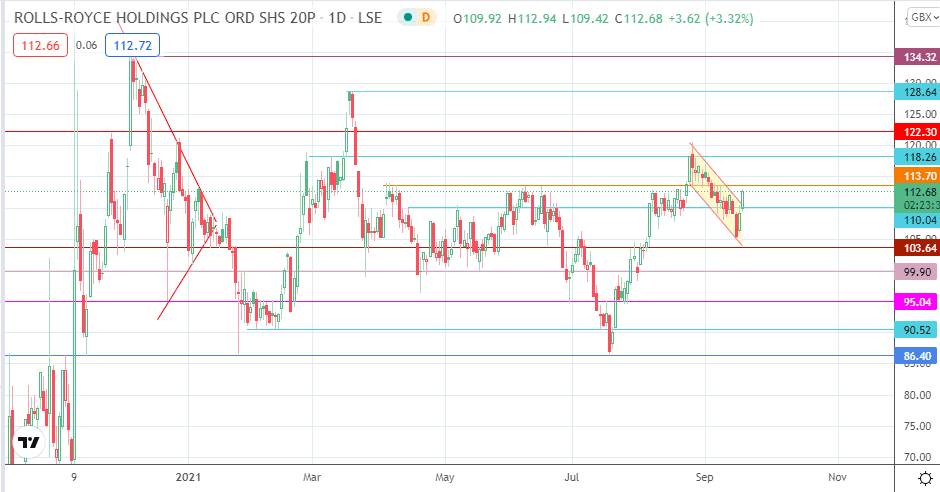

Friday’s advance follows the break of the descending channel and the 110.04 resistance mark. The 113.70 resistance barrier is now the target for bulls. If the price advance continues beyond this point, the 118.26 (26 February, 9 March and 24 August highs) and 122.30 (25 November 2020 high) resistance levels could be up for grabs.

This outlook is negated if the 113.70 resistance barrier holds firm. This scenario could allow the bears an opportunity to initiate a pullback towards 110.04 (now acting as support). A further decline targets 103.64, leaving 99.90 and 95.04 closely behind as potential targets to the south.

Rolls Royce Share Price: Daily Chart

Follow Eno on Twitter.