Rio Tinto’s share price has not been doing great lately since it released it financial report, which showed that the company’s profits were down by 29 per cent. Today, the company’s share price is down from its opening price. However, due to it opening with an up gap, today’s price drop is yet to hit yesterday’s closing drop; therefore, it is still up by almost a percentage point from yesterday’s session.

The Rio Tinto struggle in the markets has continued partly due to the cooling of demand for iron ore. The result has been weaker iron prices, which has continued to affect the company’s bottom line. For instance, since the year started, the demand for iron in China, which is one of the largest consumers, has continuously been going down.

However, the declining iron price is not the only problem Rio Tinto has had to deal with. The rising cost of living and labour shortages has also seen the company falling behind on its production and meeting its targets.

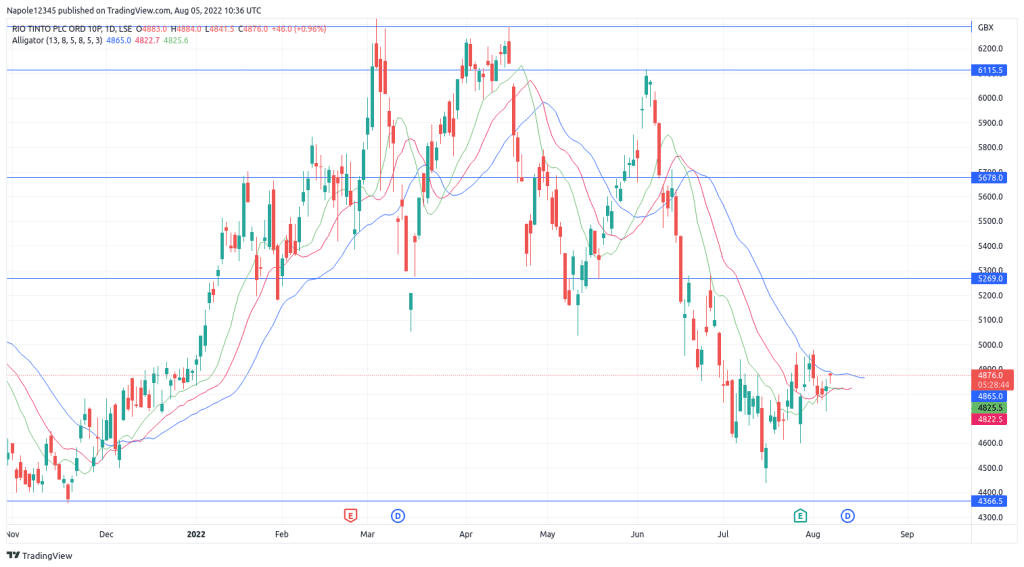

Rio Tinto Share Price

Unfortunately, the Rio Tinto problem does not seem to be over. The iron ore demand is still low, and its prices are still falling. However, for the next few trading session, there is a high likelihood that we may see the company’s price rising.

Part of the reason for my bullish trend prediction is that despite the company reporting reduced profits, its share price has remained relatively stable. Looking at the chart below, we can see that, rather than move in an aggressive bearish trend, the share prices started trending sideways. Before the reading of the financial report, the share price was also in a bullish trend.

Therefore, the recent price action points to Rio Tinto Share Price showing signs of recovery despite the ongoing problems within the company. However, should the prices trade below yesterday’s price low of 4728p, then my bullish analysis will be invalidated. It will also mean a likely move to the downside is possible.

Rio Tinto Daily Chart