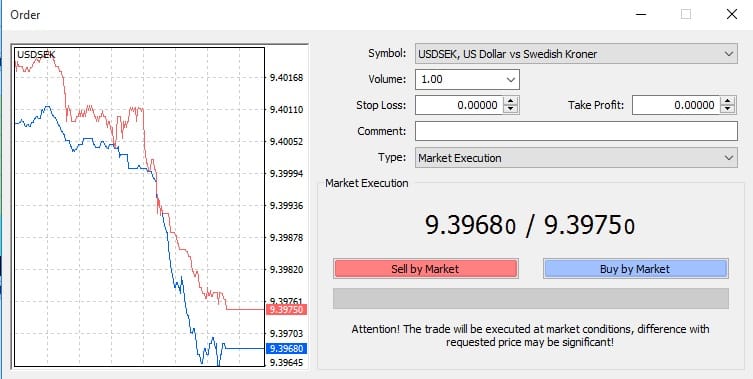

The USDSEK will be in focus as the Riksbank (Sweden’s Central Bank) prepares to make its interest rate decision public on December 19. Sweden has maintained a negative interest rate for 5 years, but this may change as the country’s policy makers are confident that the economy has received the necessary stimulus and therefore rates need to go positive once more.

A survey of analysts reveals a unanimous sentiment that the Riksbank will hike rates by at least 25bps. This view was bolstered by the rise in the consumer price index showcased last week. This has been factored in by the markets and the USDSEK has seen a consistent slide to the downside. After this increase, the Riksbank is expected to hold rates in 2020 as it reviews the impact of the rate hike.

Read our Best Trading Ideas for 2020.

Technical Outlook for USDSEK

The USDSEK is the currency in focus and even though the markets factored in a rate hike with a great move to the south, the decision itself could still yield some surprises.

If the Riksbank delivers a rate hike of 50bps or more, this is going to be SEK-positive and we could see the USDSEK plunge further to the 9.30300 price level (previous lows of April 24 as well as July 18 and 19). There is also the possibility of further extension towards the 9.23231 price area, if the markets respond very strongly to a rate hike that exceeds the 25bps expectation.

If the Riksbank delivers a 25bp rate hike, we could see a further move south but such a move would be relatively muted.

A rate hold which leaves the interest rates unchanged will have a major SEK-negative impact on the pair, which could send the USDSEK to the 9.4991 price area (channel’s upper border). Above this level, 9.54471 could become relevant if price action is quite bullish.

Don’t miss a beat! Follow us on Telegram and Twitter.

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.