USDCAD gives up 0.39 percent to 1.3115 as Loonie gets a boost from the rally above $59 per barrel in crude oil. The Energy Information Administration in its weekly report announced earlier today that the crude oil inventories in the U.S. decreased by 12.8 million barrels from the previous week. Macro data from the U.S. economy failed to attract any bids in USD as the durable goods orders declined by 1.3% on a monthly to month basis for May and the good trade deficit increase to $74.55 billion from $70.92 billion. USDCAD traders will closely follow the discussions in G20 meeting later this week for developments in China – USA trade war tensions.

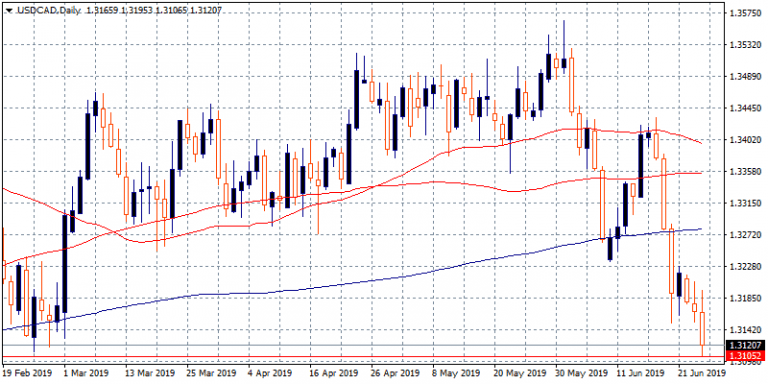

Bears are in full control as the pair trading below all the major daily moving averages. First support stands at 1.3100 psychological level while more bids will emerge at 1.3068 the low from February 1st. Immediate resistance for the pair stands at 1.3195 the daily high while a break above might trigger some aggressive buying, sending the pair to the next resistance at 1.3279 where the 200 day moving average cross.