Ocado has seen a slight recovery in its share price after it saw a massive demand surge following its joint venture with Marks & Spencer. Last week’s tie-up which sees Ocado delivering food ordered online from

Marks& Spencer has seen an unprecedented surge in demand that caused the company to cancel deliveries to staff to expand its capacity to meet this demand.

Ocado was forced to cancel some orders in the first week of the new venture, causing a social media outcry. Ocado stock witnessed two days of selling as the company struggled to handle the situation.

The new venture, which follows the acquisition of a 50% stake in Ocado by Marks & Spencer, will see Ocado shipping the full range of its 6,000-plus food products from Marks & Spencer, which are being offered online for the first time. The coronavirus pandemic had badly hit marks & Spencer’s flagship business as the UK government implemented lockdowns that kept its shoppers away from its stores. In contrast, Ocado saw massive growth in its business as the same shoppers turned to online platforms to help them out.

Ocado is trading at 2342 or 2.18% higher on the day.

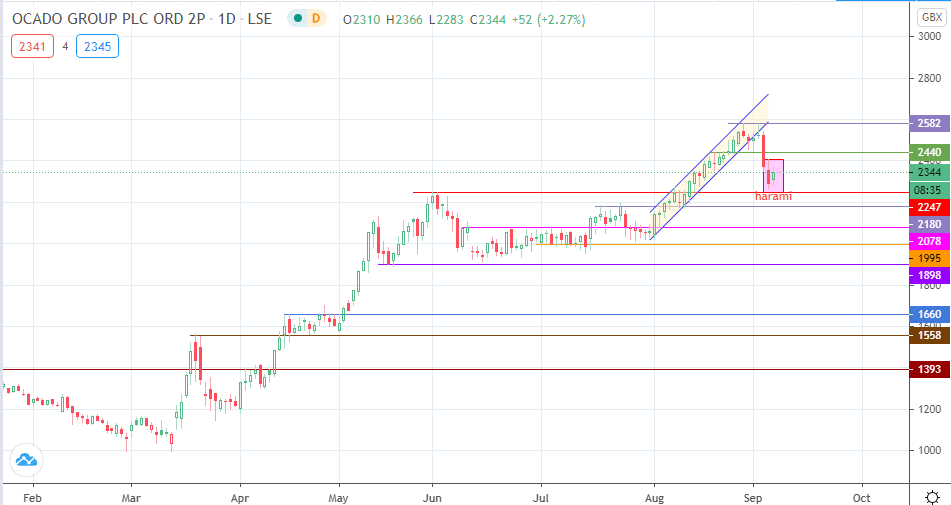

Technical Outlook for Ocado

A bullish harami is forming on the daily chart, just above the 2247 support (1/2 June and 10 August highs). The stock will require follow-through buying to take it to the 2440 price level, where the next resistance lies.

The 2582 high awaits buyers as a potential target if 2440 is surmounted. On the flip side, lack of follow-through on the bullish momentum could bring in 2247 as the next downside target, with 2180 and 2078 lining up as potential support levels for the future.

Don’t miss a beat! Follow us on Telegram and Twitter.

Ocado Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Eno on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.