The Ocado share price got off to a flying start in September, gaining 3.6% yesterday and recovering the 200-day moving average. After an incredible run in the second half of August, there were questions about whether September would be as kind. Despite only being one day into the new month, the early signs are that Ocado can improve upon last months performance.

Despite Grocery delivery giant Ocado Group Plc (LON: OCDO) trading at a 14-month low in July, some analysts predicted even more downside. Last month, Barclays called Ocado ‘excessively high’ and slashed their 12-month price target to 1,575p. However, the shares have jumped more than 20% since then, from 1,742p to almost 2,100p. As a result, Ocado has cleared several technical hurdles that were previously weighing down the price. And this could lead to the price squeezing even higher.

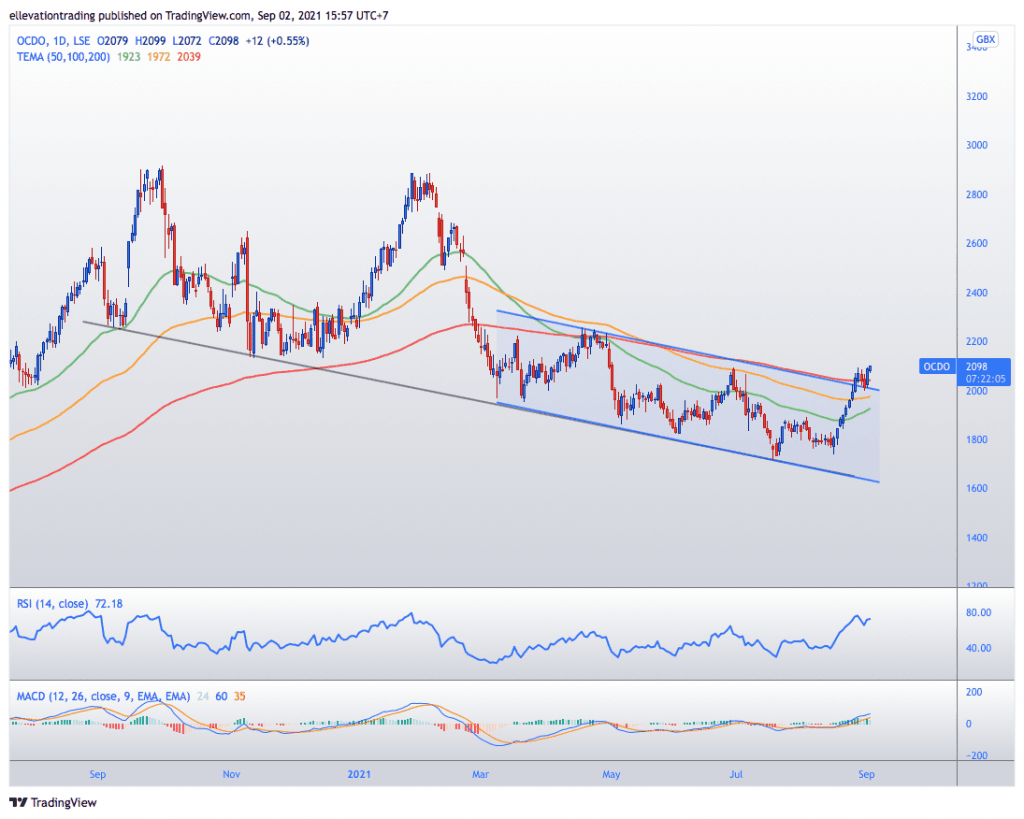

OCDO technical Analysis

Turning to the daily price chart, we see the Ocado share price has climbed above the 200-day moving averages at 2,039p and cleared a descending trend line at 2,008p. Furthermore, a successful retest of the trend on Tuesday reinforces the breakout’s credentials.

As long as OCDO remains above the trend and the 200 DMA, it should continue higher. A logical target ion the upside is the April high at 2,255p. Following that, 2,500p becomes the next target for the bulls. However, this view depends on trend support holding. And on that basis, if Ocado drops below 2,008p, the bullish view becomes invalid.

Ocado Share Price Chart

For more market insights, follow Elliott on Twitter.