- Ocado share price continues on a downward trajectory.

- Ocado and several others recall food after a warning from the Food Safety Agency.

- Stock was downgraded by Credit Suisse last week.

Ocado is one of the companies within the supermarket supply chain that has issued warnings over some of their meat and chocolate products, following an update from the Food Standards Agency (FSA).

The Birmingham Live news agency report says that the FSA issued a list of products in several supermarkets with incorrect labels and defective expiration date stamps, necessitating a wide-scale recall of the affected products.

Ocado was also in the news last week after investment bank Credit Suisse downgraded the stock to “underperform”, reducing its price target from 1550p to 1500p. The current price action shows that the Ocado share price has tilted significantly in the direction of the projections from Credit Suisse. It is trading 1.02% lower on the day.

Ocado Share Price Outlook

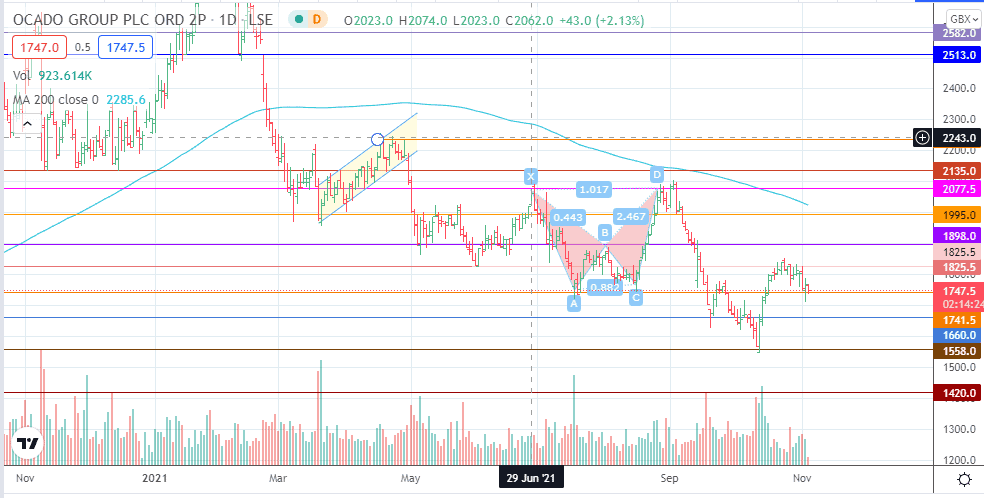

The price activity is now challenging the support at the 1741.5 price mark. If it breaks this level, 1660.0 becomes the new price target. The 12 October low at 1558.0 only becomes available if the decline continues.

On the other hand, a bounce at the current support allows for a push towards 1825.5 initially, while 1898.0 becomes a new target if the price action advances beyond 1825.5. 1995.0 could be a formidable resistance barrier, as it has added strength from the overhanging 200-day moving average. If the bulls overcome these two barriers, 2077.5 and 2135.0 could come into the picture as potential new targets to the north.

Ocado: Daily Chart

Follow Eno on Twitter.