The Nvidia share price is in trouble. The NVDA stock price has dropped from an all-time high of $346 in 2021 to $169. And the situation is about to worsen, considering that the shares have crashed to $159 in the extended-hours session. As a result, the company’s market cap has moved from an all-time high of more than $600 billion to about $423 billion.

Why is NVDA crashing?

There are several reasons why the Nvidia stock price has been in a strong bearish trend in the past few months. First, the decline is in line with other technology companies’ performance in the past few months. A quick look shows that most chip stock like Taiwan Semiconductor, AMD, and Broadcom shows that they have all declined. Similarly, all tech companies like Microsoft, Apple, and Google have crashed.

Second, the company’s key segments are expected to continue falling. For one, Bitcoin mining demand is set to plummet as the prices decline. Similarly, Gaming is expected to struggle in the coming months as many gamers go back to work. Besides, PC gamers have grown to over 100 million in the past two years.

Third, there is a sense in which that Netflix is one of the most overvalued stocks. This company generated over $25 billion in revenue in 2021 and a profit of over $9.5 billion, valued at over $600 billion. In other words, the firm had a PE ratio of over 63. Historically, when this happens, a stock tends to retreat when growth that supported the valuation slows.

Nvidia earnings review

The Nvidia stock price is reacting to the company’s earnings. Total revenue rose to more than $8.3 billion in the first quarter. This was a 46% YoY growth. However, gaming revenue rose by just 6% to over $3.6 billion, helped by GeForce RTX Series.

Pro Visualization revenue fell to $622 million, helped by Nvidia RTX Ampere. Further, the automotive sector rose by 10% to $138 million, while data center rose by 15% to $3.8 billion. The Nvidia share price declined after the company warned about its growth. In a note, the company said:

We expect strong sequential growth in Data Center and Automotive to be more than an offset by the sequential decline in Gaming. As a result, revenue is expected to be $8.1 billion, plus or minus 2%.”

Nvidia stock price forecast

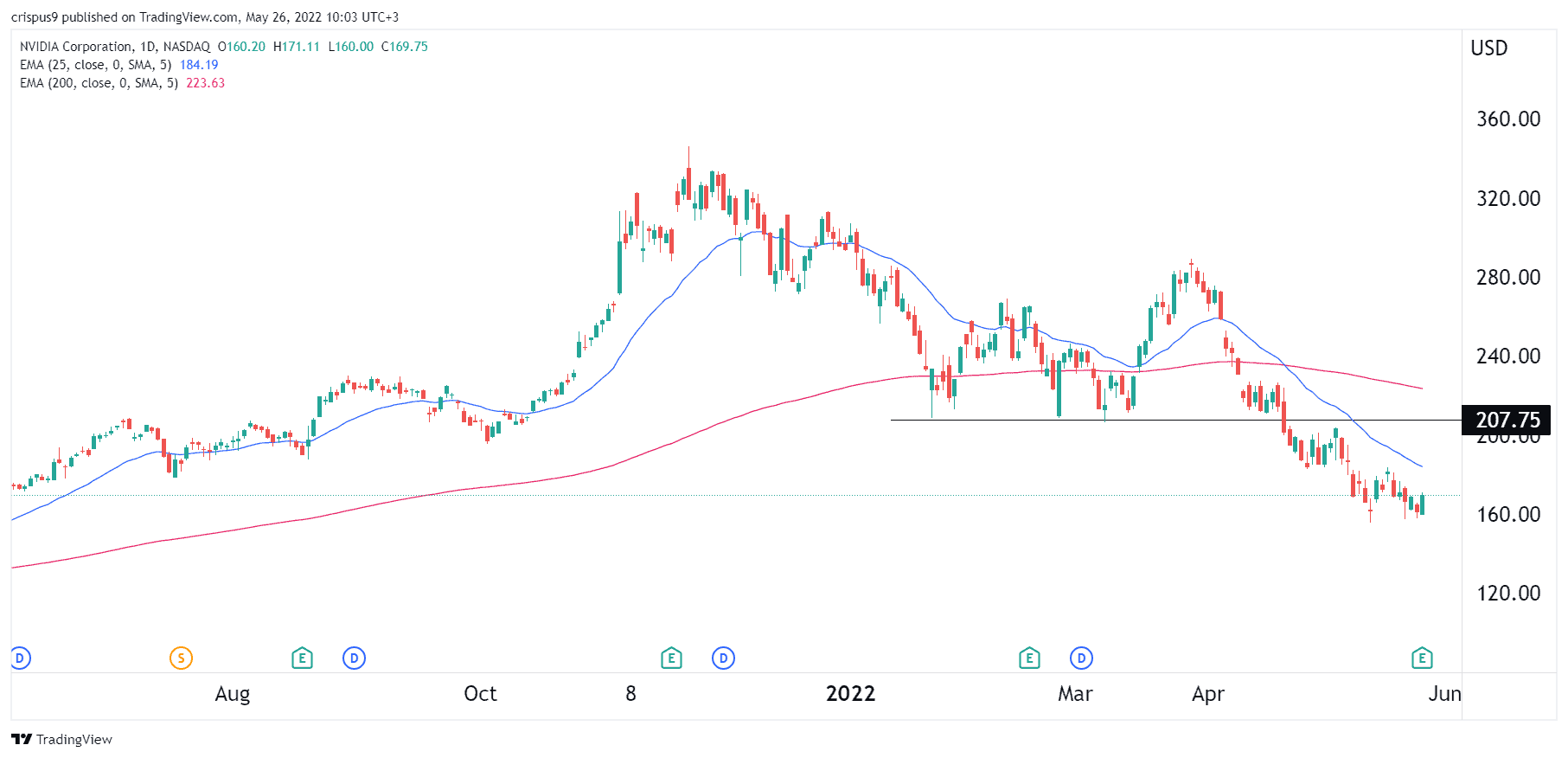

The daily chart shows that the NVDA stock price has been in a strong bearish trend. Along the way, it has formed a death cross pattern, which is usually a bearish sign. The stock has moved below the important resistance level at $207, which was the lowest level on May 9th. Therefore, the stock will likely keep falling as bears target the next key support level at $100, which is about 40% below the current price. A move above the resistance level at $207 will invalidate the bearish view.