The Nio share price closed higher last week, buoyed by the 1.39% uptick seen on Friday, 12 August. It has begun the day slightly lower, but the bulls have seized the early initiative and have closed off the opening gap to keep the stock on bid.

The Nio share price is coming off a period of correction following headwinds that have confronted the EV industry in China. From the COVID lockdowns to the shortage of semiconductor chips and high inflation, Nio Inc continues to brave the odds despite its difficulties in meeting demand.

Vehicle orders continue to rise, but the impediments mentioned above mean that the Nio share price has been unable to benefit from this. The company saw its March 2022 fiscal quarter results decline further, widening its losses by 760.4% compared to the same period a year ago.

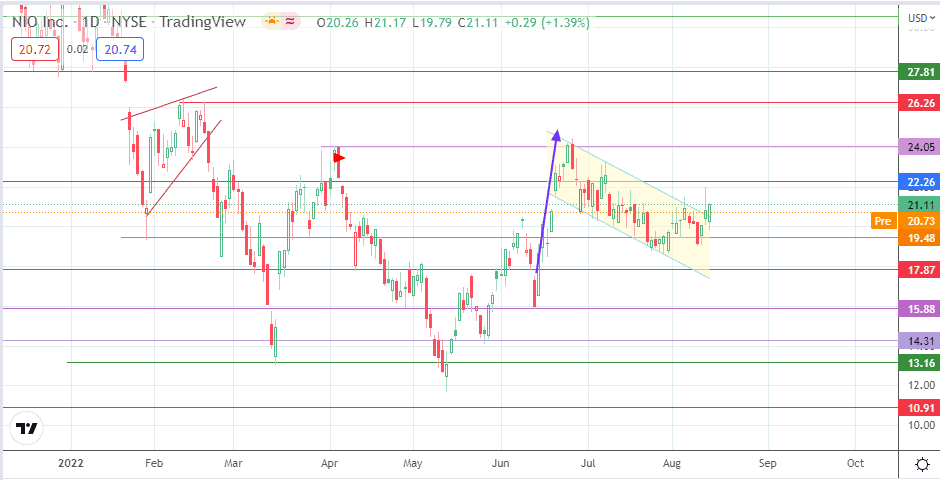

The outlook is for the company to post a negative fiscal year in terms of earnings despite posting a 22% rise in EV deliveries over its 2021 figures. From the standpoint of technical analysis, completion of the evolving bullish flag gives the Nio share price the potential to attain the $26.26 price mark in the near term.

Nio Share Price Forecast

The break of the upper border of the bullish wedge pattern completes the pattern’s evolution and clears the way for the bulls to aim for the completion of the breakout move at 26.26 (17 February high). First, however, the obstacles posed by the 22.26 price mark (2 March and 31 March highs) and the 24.05 (5 April and 24 June highs) must be uncapped by the bulls to make this move a reality.

Then, further north, the 27.81 resistance formed by the 20 December 2021 and 10 January 2022 lows presents itself as an additional upside target. Attainment of this target closes the 24 January 2022 downside gap.

On the other hand, a decline below the 19.48 support, coming from a possible rejection at 22.26, truncates the breakout move. This decline below the 28 January, 25 March and 3 August lows provides access to the 17.87 support, where the 3/10 June lows are located. Additional harvest points for the bears are 15.88 (28 April and 13 June lows) and 14.31, the site of the prior low of 16 May.

Nio: Daily Chart