The Nio share price is trading lower and appears set for a second day of losses. This comes on the back of continued market contagion from Evergrande’s liquidity crisis that led to a widespread selloff on Asian and US exchanges.

Despite good market prospects, Nio share price continues to struggle under the weight of the global shortage of semi-conductor chips. This shortage drove down Chinese auto sales by 17.8% in August, marking a 4th consecutive monthly drop. This shortage has also impacted vehicle sales of automakers Ford, Honda, Volkswagen and GM.

The liquidity crisis besetting property giant Evergrande continues to exert bearish sentiment around Chinese stocks. Consequently, the Nio share price could face additional near-term headwinds. The stock is down 0.11% as of writing.

Nio Share Price Outlook

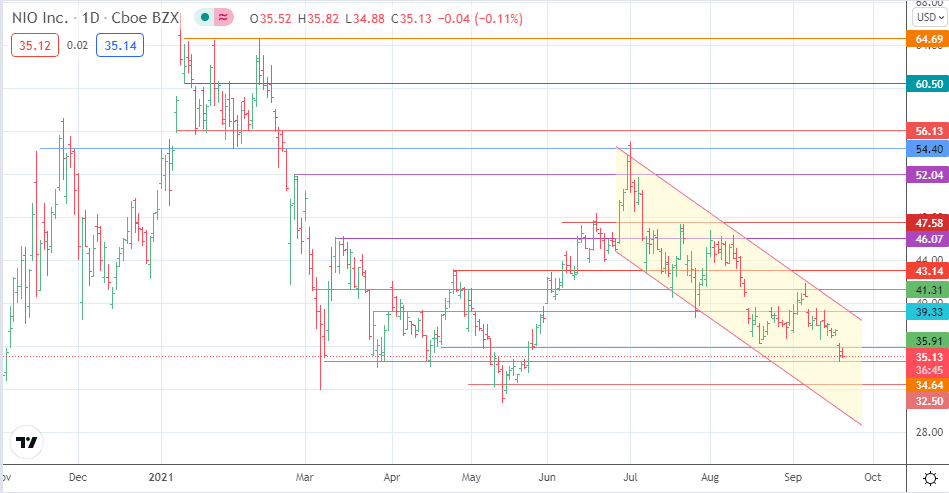

The Nio share price is currently testing the 34.64 support level. If this pivot gives way, we may see the price approaching 32.50 as the next downside target.

On the flip side, a bounce at the current support could enable the price to overcome the barrier at 35.91. An advance following this move allows the bulls to aim for the 39.33 resistance barrier. This area is where the channel’s trendline is found. Therefore, we can expect 41.31 and 43.14 to become available once the price breaches the channel’s upper edge and the 39.33 resistance level. 46.07 and 47.58 will become available as new targets if price recovery above 39.33 occurs.

Nio Share Price (Daily)

Follow Eno on Twitter.