Asian indices and Nikkei 225 finished sharply lower on Monday as investors dump risky assets after President Trump rattled markets as he announced an additional 10% tariffs on the remaining USD300 billion worth of US imports from China, starting September 1st. The Hang Seng finished 2.79 percent lower at 26,166, the Singapore Straits Times index finished 1.98 percent lower at 3,196 and the Shanghai composite ended 1,62 percent lower to 2,821. Aussie stocks also finished lower, ASX lost 1.90% at 6,640 in the worse day of 2019, despite Australia Commonwealth Bank Services PMI came up to 52.3 in July from previous 51.9.

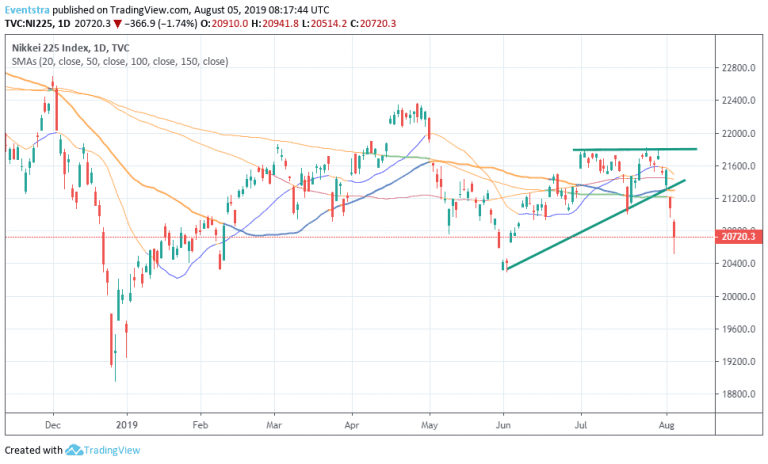

Nikkei 225 finished 1.74% lower at 20,720 in risk off mood as US – China trade war tensions escalate. Japan Markit Services PMI registered at 51.8, below expectations of 52.3 in July.

Nikkei 225 trades now at two month low looking for support at 20,315 the lows from early June. A break below that level might trigger a selloff below the 20,000 mark. On the upside resistance for the Nikkei 225 stands at 20,941 today’s high, and then at 21,292 the 50 day moving average.

In Asian forex markets USDJPY trading 0.60 percent lower at 105.93, the Aussie dollar trades 0,60% lower against greenback at 0.6757, while Kiwi also trades lower at 0.6516 versus USD. Gold is trading higher at 1,456, while crude oil is 1,46 percent lower at $54.85 per barrel.Don’t miss a beat! Follow us on Twitter.