Asian indices finished mixed as investors evaluate the inverted US Treasury Yield curve amid geopolitical tensions. The Hang Seng trading 0.28 per cent lower at 25,546, the Singapore Straits Times index finished 0.11 per cent higher at 3,060 and the Shanghai composite ended 0,10 per cent lower to 2,890. Aussie stocks finished higher, the ASX ended 0.10% higher at 6,507.

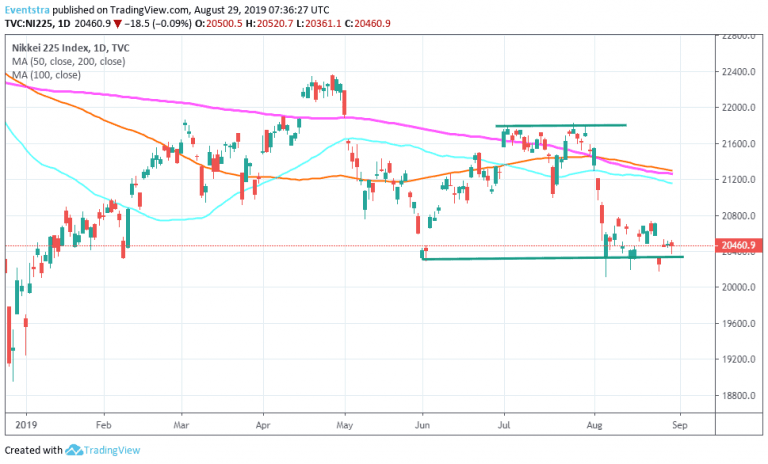

Nikkei 225 finished 0.09% lower at 20,460 as Chinese will travel to USA to restart the trade negotiations. Nikkei 225 getting a boost from Rakuten +2.36, Taisei 2.33%, Pacific Metals +2.11% and Toppan Printing +1.96%. On the other hand, Recruit Holdings is -4.80%, Unitika -3.90%, DeNA -3.13 and IHI Corp. -2.32%.

The Nikkei consolidates for the third day in a row above seven-month lows and above the strong support at 20,330. On the downside, immediate support stands at 20,361 today’s low and then at 20,200 the low from August 15th. A break below that level might accelerate the selloff below the 20,000 mark. On the upside resistance for the Nikkei 225 stands at 20,520 today’s high and then at 21,156 the 50 day moving average.

In Asian forex markets USDJPY trading 0.05% lower at 106.05, the Aussie dollar trades 0,01% lower against the greenback at 0.6733, while Kiwi trades 0.19% lower at 0.6324 versus USD. Gold approaches the recent high and trades at 1,545, while crude oil is 0.02% higher at $55.79 per barrel.