Nikkei 225 index ended higher on Tuesday on improved sentiment after the tech stocks sell-off in Wall Street the previous week. Wall Street will set the pace as the markets reopening today after the Labor Day Holiday. News about progress in the coronavirus vaccine from Russia might also boost risky assets.

The Japanese economy contracted more than the initial reading in the second quarter. The Japan Gross Domestic Product (GDP) shrank by -7.9%, slightly worse than the initial estimate of 7.8%. Analysts were expecting a contraction of -8.1%. The annualized GDP came in at -28.1% better than expectations of -28.6%. Japan Trade Balance in July registered in at ¥137.3B, topping the expectations of ¥-181.3B. The Overall Household Spending in Japan came in at -7.6%, below the analyst’s consensus of -3.7% in July, as consumers were cautious amid the coronavirus pandemic.

In other data, the Japan Eco Watchers Survey Current in August registered in at 43.9, above the expectations of 33.3. The Outlook survey came in at 42.4, also above the expectations of 28.2.

Asahi Group, Shinsei Bank and NTN Corp are among the top gainers. Softbank extended losses for the second day after yesterday lost almost 7% after news that the company invested heavily in U.S. stocks and call options on the big tech companies.

Nikkei 225 Analysis

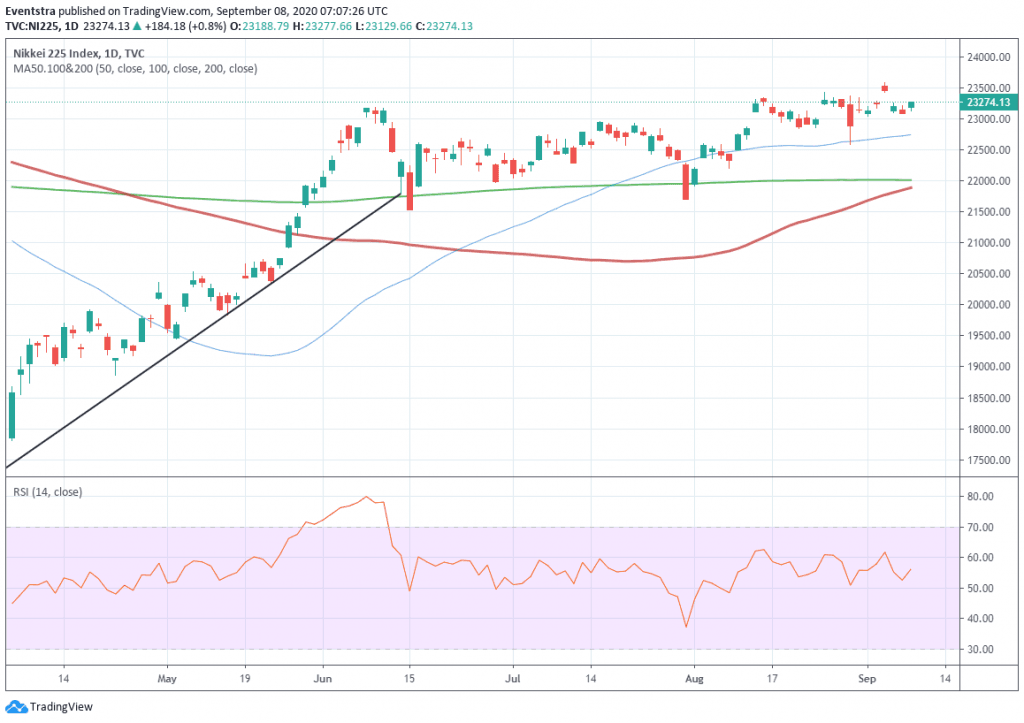

Nikkei 225 is 0.80% higher at 23,274, keeping the positive momentum alive after the sharp correction the previous week. The technical picture keeps the positive momentum as long as the index stays above the 50-day moving average. Resistance for Nikkei 225 stands at 23,277 the daily high. The previous week highs at 23,601, is the next supply area.

On the contrary, the daily low at 23,129 would provide minor support. Next support zone stands at 23,045 the low from yesterday’s trading session. A break below the 50-day SMA at 22,747 might cancel the bullish momentum, and sellers would take control for the short term.

Investing Cube runs one-to-one Trading Coaching, which is a great way to learn trading techniques.

Don’t miss a beat! Follow us on Telegram and Twitter.

Nikkei 225 Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Nikolas on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.