The Nikkei 225 is up by more than 0.60%, continuing the bullish trend that started in Wall Street yesterday. The index is trading at ¥23,190, which is higher than yesterday’s low of ¥22,870. Other indices in Asia are mixed, with the Hang Seng falling by 0.15% and Shanghai composite rising by 0.10%.

Softbank is a key company of interest in Japan after it emerged that it was the whale that helped push US tech companies higher in the past few months. The firm did that by buying options worth billions of dollars leading to unrealized profits worth $4 billion.

While this bet made the company money, shareholders are questioning the new business model of the firm. Indeed, investors who have contributed to the Vision Fund 2 are concerned because they expected these funds to go to privately-owned companies. Still, the rally in American shares yesterday have helped push Softbank shares higher. They are up by more than 2% and are trading at ¥5,790.

The Nikkei 225 is also reacting to relatively strong economic data from the country. Data released by the Ministry of Finance showed that machinery orders rose by 6.3% in July after falling by more than 7.3% in the previous month. Still, the orders fell by 16.2% on a year-on-year basis. This is a good thing for the Nikkei since many firms in the index are involved in the machinery industry.

Separately, Japan stocks are rising because of the political environment in the country. Indications point to Yoshihide Saga as the next prime minister of Japan. As such, analysts believe that he will seek to continue with Shinzo Abe’s policies, which have been relatively good for the economy.

The best-performers in the Nikkei 225 are Mitsui O.S.K Lines, Rakuten, Kowasaki Kisen Kaisha, Nippon Yusen, and DeNa Co that have gained by more than 4.5%. On the other hand, the worst-performers are Suzuki, Isetan Mitsukoshi, Tokyo Electron, and Toho.

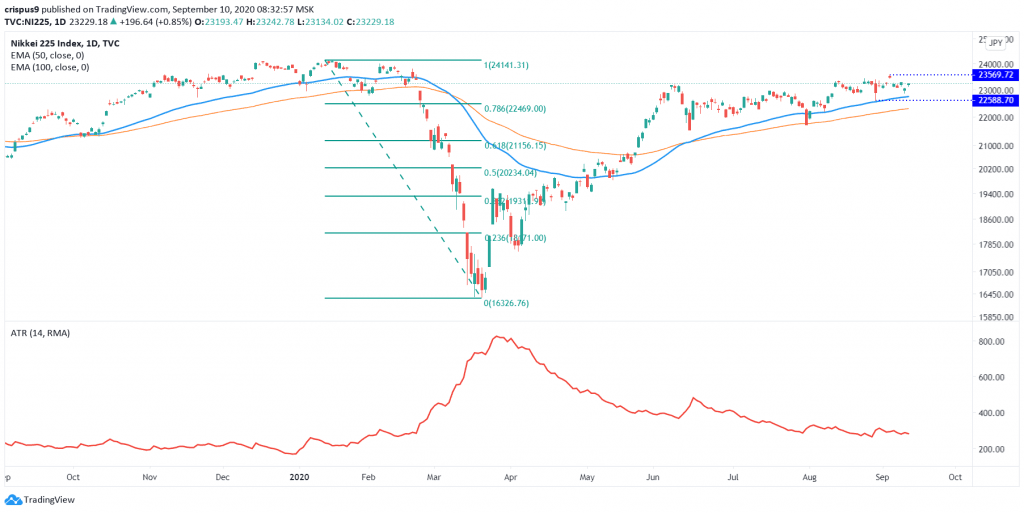

Nikkei 225 technical outlook

The daily chart below shows that the Nikkei 225 index has been moving sideways in the past few weeks. The price is still above the 50-day and 100-day exponential moving averages and the 78.6% Fibonacci retracement level. However, its volatility, as measured by the Average True Range (ATR) has continued to fall.

Therefore, the outlook for the index at this point is neutral, meaning that it can break-out in either direction. The key support and resistance levels are ¥22,588 and ¥23,570, respectively. These levels are the lowest level on August 28 and the highest point on September 3, respectively.

Do you want to be an excellent trader? Register for our free forex trading course and get trained by traders with decades of experience in the industry.

Don’t miss a beat! Follow us on Telegram and Twitter.

Nikkei 225 Technical Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.