The Nikkei 225 index rose on Monday morning as investors reacted to the latest elections in Japan and the upcoming earnings season. The NI225 index rose to a high of ¥26,870, which was the highest point since June 28th of this year. It has risen by more than 5% from its lowest level in June of this year.

Yen crash continues

The Nikkei 225 index rallied after the latest Japanese election fueled a major yen sell-off. The USD/JPY price surged to a high of 137, which was the highest point in more than 20 years. The Japanese yen has crashed by more than 8% from its lowest level in more than 24 years. The EUR/JPY price also surged.

The USD/JPY pair rose sharply as Bank of Japan’s Haruhiko Kuroda vowed to add more stimulus in a bid to continue supporting the economy. As such, the divergence between the BoJ and the Federal Reserve widened after the strong jobs numbers in the United States. The data showed that the country’s unemployment rate remained at 3.5%.

A weak Japanese yen benefits many Nikkei companies that sell their products abroad like Toyota and Nissan. However, these companies also suffer as the cost of their imports surges.

The Nikkei 225 index rose after the victory by the ruling party gave the current prime minister a strong mandate to implement his policies. Further, the index rose as investors waited for the upcoming earnings season in the United States. Companies like Morgan Stanley, PepsiCo, and JP Morgan will provide a clear gauge of the ongoing recession risks.

The top-performing Nikkei index stocks were firms like JGC Corp, Mitsubishi Motors, Shinsei Bank, Marui Group, and Nissan Motor. On the other hand, the top laggards in the index were Toray Industries, Tokyo Electron, Toyobo, and Mitsui OSK Lines.

Nikkei 225 forecast

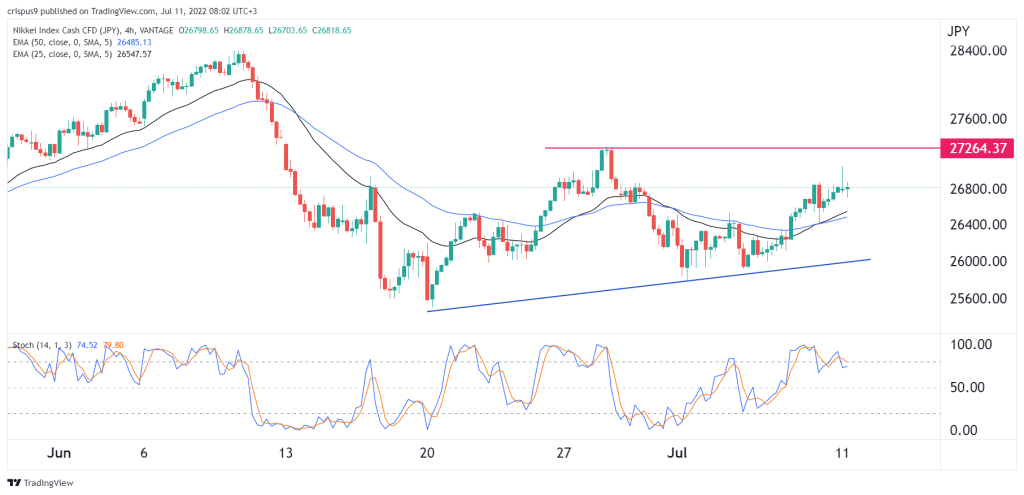

The four-hour chart shows that the Nikkei 225 index has been in a strong bullish trend in the past few days. In this period, it has remained above the ascending trendline shown in blue. It has also risen above the 25-day and 50-day moving averages while the Stochastic Oscillator has moved above the overbought level.

Therefore, the index will likely keep rising as investors target the key resistance level at ¥27,265, which was the highest point on June 28th