Asian markets are trading higher today as investors buoyed by positive moves from US and China on the trade war front. ECB delivered the easing expected by the markets and that will pressure and other central banks to increase stimulus. The Hang Seng trading 0.68 per cent higher at 27,265, the Singapore Straits Times index finished 0.51 per cent higher at 3,210. Aussie stocks finished higher; the ASX 200 ended 0.18% higher at 6,667.

Nikkei 225 finished 1.05% higher at 21,988 after Japan Capacity Utilization rose from previous -2.6% to 1.1% in July. The Japan Industrial Production (month over month) came unchanged at 1.3% in July, Japan Industrial Production (year over year) remains unchanged at 0.7% in July.

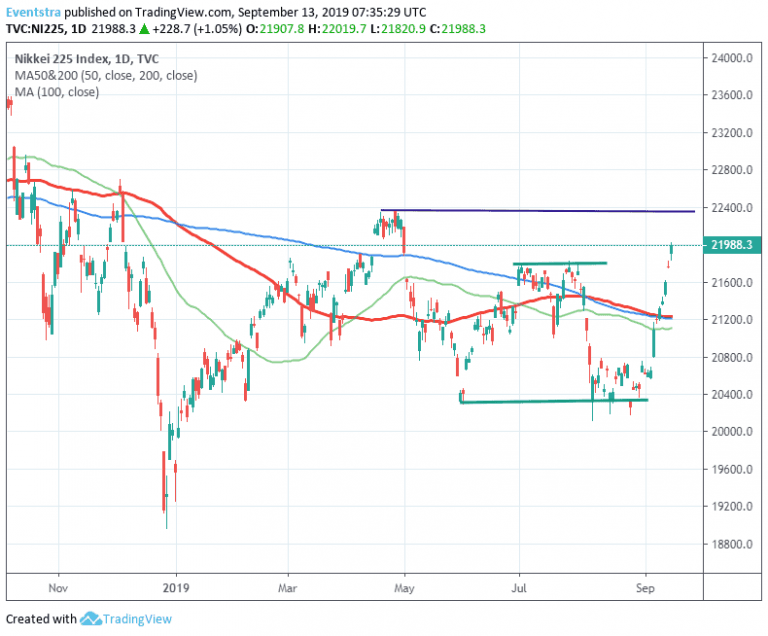

The Nikkei continues the impressive rally for ninth consecutive trading session building on recent bullish momentum and reaching the upside targets for the index that we mentioned in our Nikkei technical analysis article yesterday. On the upside the index has cleared all the hurdles and now faces the 22,019 today’s high, the 22,180 the high from May 7th while a break above, might set the stage for a move up to 22,335 yearly high.

On the downside immediate support stands at 21,820, today’s low and then at 21,226 the 100-day moving average. A break below that level might accelerate the selloff down to 21,108 and the 200-day moving average.

In Asian forex markets USDJPY trading 0.04% lower at 108.04, the Aussie dollar trades 0,13% higher at 0.6875, while Kiwi trades 0.01% higher at 0.6404 versus USD. Gold trades lower today at 1,502, while crude oil is 0.07% lower at $55.05 per barrel.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.