Asian markets are trading higher today on improved sentiment as investors await the ECB decision on Thursday. The Hang Seng trading 1.51 per cent higher at 27,086, the Singapore Straits Times index finished 1.15 per cent higher at 3,192, and the Shanghai composite ended 0,41 per cent lower at 3,008. Aussie stocks finished higher; the ASX 200 ended 0.36% higher at 6,614, despite the Consumer confidence fell by 1.7% to 98.2 in September.

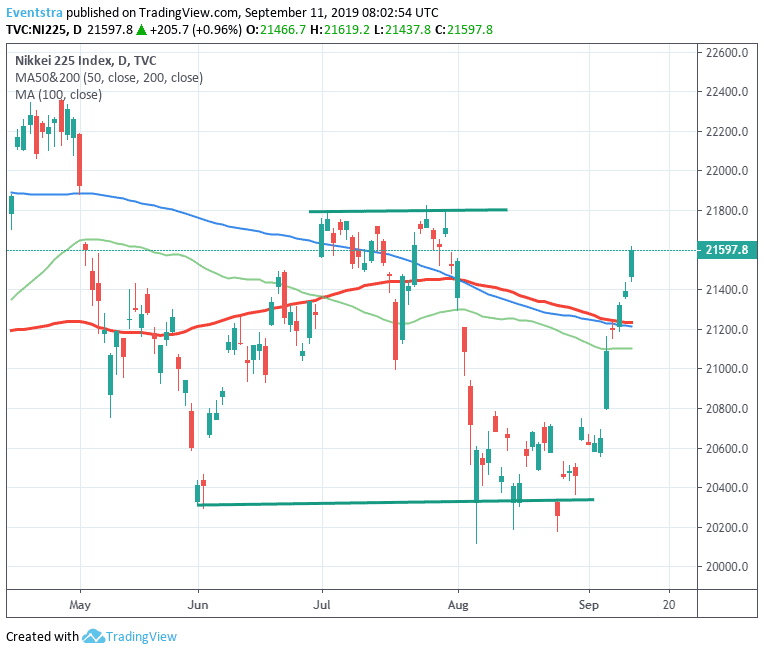

Nikkei 225 finished 0.96% higher at 21,597 after Japan BSI Large Manufacturing Conditions Index (quarter over quarter) came in at -0.2 in 3Q from the previous reading of -10.4.

Nikkei getting a boost from Chiyoda +6.67%, Concordia +6.33%, Fukuoka +6.67%, Resona +6.25%, Nomura +5.33%, and Inpex +4.98%. On the other hand Chugai -3.39%, Mitsui -1.61%, Olympus -1.29%, Rakuten -1.17% and Fujitsu -1.23%.

The Nikkei continues north for seventh consecutive trading session enhancing the recent bullish momentum. On the upside resistance for the Nikkei 225 stands at 21,619 today’s high, a break above, perhaps will set the stage for a move up to 21,804 the high from July 30th. On the downside immediate support stands at 21,437, today’s low and then at 20,795 the low from September 5th. A break below that level might accelerate the selloff down to 20,500 mark.

In Asian forex markets USDJPY trading 0.01% higher at 107.25, the Aussie dollar trades 0,10% higher at 0.6868, while Kiwi trades 0.04% lower at 0.6420 versus USD. Gold trades lower at 1,490, while crude oil is 0.77% higher at $57.84 per barrel.Don’t miss a beat! Follow us on Telegram and Twitter.

Download our latest quarterly market outlook for our longer-term trade ideas.

Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.