The Near Protocol price has been under intense pressure in the past few weeks. The coin’s price has crashed by more than 45% below its highest level in October. It is also hovering near its lowest level since September this year.

What is the Near Protocol?

Near is a blockchain project that aims to create an excellent ecosystem for developers to build projects like DeFi and Non-Fungible Tokens (NFT). It recently received millions in funding from Andreessen Horowitz, one of the best-known venture capitalists in the world.

The platform uses proof-of-stake technology combined with an adaptive sharding. It recently started the process of moving to full sharding in October. At present, it is sharding the state and not the process. This process makes transactions in the network relatively faster.

However, like most Ethereum-killers, Near Protocol faces challenges ahead. For example, it faces the challenge of having to compete with Ethereum, which is the biggest smart contract network in the world. It is also competing with other Ethereum-killers like Solana and Binance smart chain.

Near’s competitive edge is in its average speed per second, which is faster than most platforms. For example, it can process more than 100k transactions per second.

Near price prediction

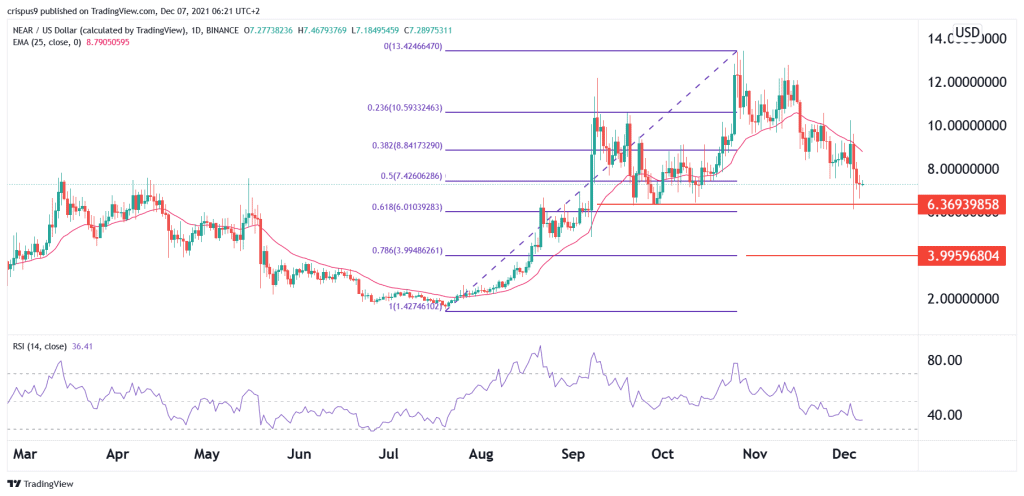

The daily chart shows that the Near Protocol price declined to a low of $6.36 during the weekend. This was an important level since it was the lowest level since October. It was also the chin of a double-top pattern that has formed recently. The coin also moved below the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has also declined.

Therefore, while the Near price has stabilized, the overall outlook is bearish and there is a likelihood that the price will fall to the 78.6% retracement level at $4. This price is about 43% below the current level.