Wall Street indices started lower with the Dow Jones currently trading -0.12% lower at 27,307. The S&P 500 is also trading 0.21% lower at 2,997.90, while the Nasdaq gives up 0.13% at 8,212 after yesterdays comments from Donald Trump when he suggested talks between U.S. and China have stalled and warned that he could apply new tariffs on $325 billion worth of China import goods in the months ahead. Housing starts fell 0.9% in June below the analyst forecasts of 1.9% and from the prior month to1.253 million when 1.260 were expected. Residential building permits which shows how much construction is in the pipeline, declined 6.1% from May to an annual rate of 1.220 million, which was the biggest monthly drop since March 2016. Analysts were expecting 1.300 million. At 18:00GMT the Fed will release its Beige Book on the economy. Beige book, is a snapshot of current business conditions around USA, is published two weeks before the monetary policy meetings of the Federal Open Market Committee.

I still believe that the global reflation scenario is intact and easier credit conditions from most of the major central banks, including the Fed, are coming and will be the dominant fundamental that supports global stock indices in the long term. Futures markets are predicting almost a 100% probability that the FOMC will lower its fed funds rate by 25 basis points at its July 30-31 monetary policy meeting. A second rate cut is anticipated before the end of the year.

The Bank of America (BAC) Q2 GAAP EPS came in at $0.74 beating estimates by $0.03. The revenue came in at $23.1B an increase of 2.7% Y/Y but below expectations by $30M.

The Bank of New York Mellon (BK) Q2 EPS came in at $1.01 beating analysts’ expectations by $0.05. The revenue came in at $3.92B in line with expectations and -5.3% lower than the previous year.

Later today we are waiting the NFLX earnings report. For more on Netflix you can check our NFLX EARNINGS PREVIEW: Netflix Expands Internationally

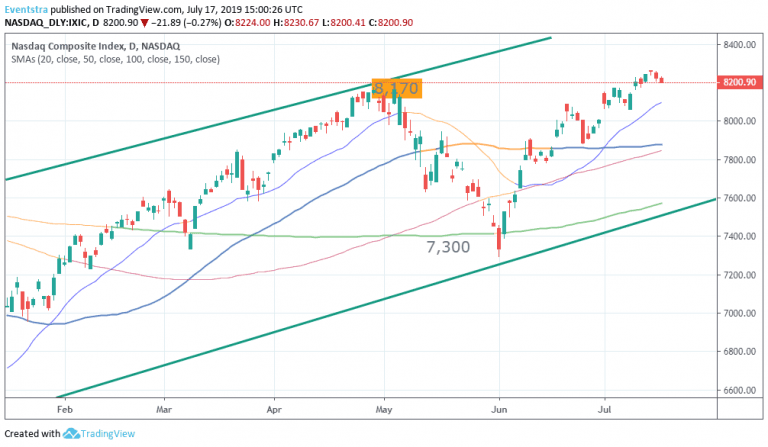

Nasdaq trading above all the key daily moving averages and the bulls are ruling the game for the short term while for the midterm is on a rising trend channel. On the upside immediate resistance is at the weekly and yearly high at 8,260. On the downside Nasdaq first support stands at 8,097 the 20 day moving average while extra bids will emerge at 7,879 the 50 day moving average. Traders will keep their long stock position as far the index is trading above the 8,000 mark.

In European Indices the selling has intensified as we are approaching the closing bell the FTSE 100 is giving up 0.47 percent to 7,541.75 as the pound trades above 1.24. DAX 30 is down 0.55 percent to 12,362 while CAC 40 in Paris also trades 0.48 percent lower at 5,588.Don’t miss a beat! Follow us on Twitter.