The Nanoco share price is trading 0.77% higher this Wednesday. This comes after yesterday’s decline that erased the gains of the previous two trading days. The Nanoco share price has experienced bursts of price appreciation in 2022. Firstly, it was up nearly 50% after it secured a favourable ruling in a patent infringement case against Samsung in May.

This price appreciation continued into mid-June after the company said it expected to beat its previous FY2022 revenue forecasts after it secured a new work package with a European client that kicked in on 1 May.

The Nanoco Group recently conducted a round of fundraising, described as oversubscribed. A non-executive director recently sold 5,000,000 units of the company’s shares at an average Nanoco share price of 34p. A look at the trading history of Henry Turcan, the director in question, showed that there were several transactions in June 2022.

Specifically, a sale of 2,768,626 units occurred at a price of 41p. There were two subsequent purchases done at lower prices before the recent sale. Despite the sales of shares by a non-executive director recently, the stock has remained stable and is presently in consolidation.

Nanoco Share Price Forecast

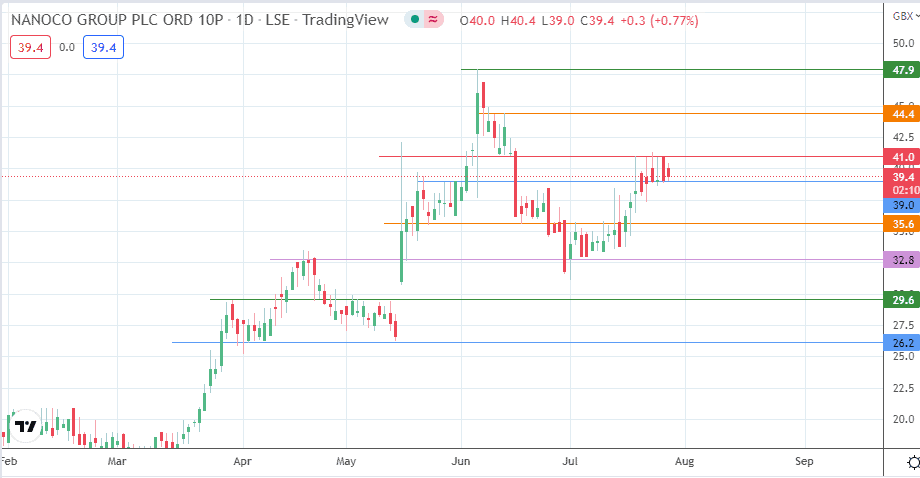

The price action is presently range-bound, with the 41.0 price mark (16 June low, 19/21 July highs) forming the ceiling of the range and 39.0 acting as the price floor (30 May high and 22 July low). A ceiling break must also take out the 16 June high and psychological price point at 39.0 to attain a new upside target at 44.4.

This price mark (13/15 June highs) is the only barrier standing between the bulls and the 2022 high at 47.9, which was seen on 8 June 2022. Conversely, a breakdown of the 39.0 support level brings in 35.6 as the new downside target, being the site of prior lows of 24 May and 21 June 2022.

The 21 July low at 38.8 may be an intervening pivot. However, if the bears push past this level and the 35.6 support, 32.8 (18 May low) becomes the next target. 29.6 rounds off potential targets to the south, and it becomes viable if the bulls cannot defend 32.8.

Nanoco: Daily Chart