Micron share price has been in a steep sell-off this year as concerns about semiconductor demand rise. MU stock price collapsed to a low of $48.42, which was the lowest level since November 2020. It has crashed by about 50% from its all-time high, giving it a market cap of over $55 billion. Other chip stocks like AMD and Nvidia have also crashed lately.

Micron earnings review

Micron stock price collapsed after the company warned of a “rapidly weakening customer demand and significant customer inventory levels. It is sitting on inventories worth about $6.7 billion. As a result, its total revenue crashed by 23% to $6.6 billion. For its fiscal year, the firm’s revenue surged to more than $30.8 billion. DRAM’s revenue dropped by 23% to $4.8 billion. NAND revenue came in at $1.7 billion.

By segment, Compute and Network’s revenue crashed by 25% while its Mobile Business Unit declined by 23%. Embedded Business Unit crashed by 9%. All this signals that the company’s business is unraveling as demand slides. It is also a warning sign to investors who hold other semiconductor stocks like AMD, Intel, Nvidia, and Taiwan Semiconductor.

In its statement, Micron said that it will continue facing challenges. For one, it expects that its NAND and DRAM shipments will continue falling as demand wanes. All this is happening because of the significant appreciation of the US dollar that has made it severely expensive to upgrade. Companies are also preserving their cash.

Micron share price outlook

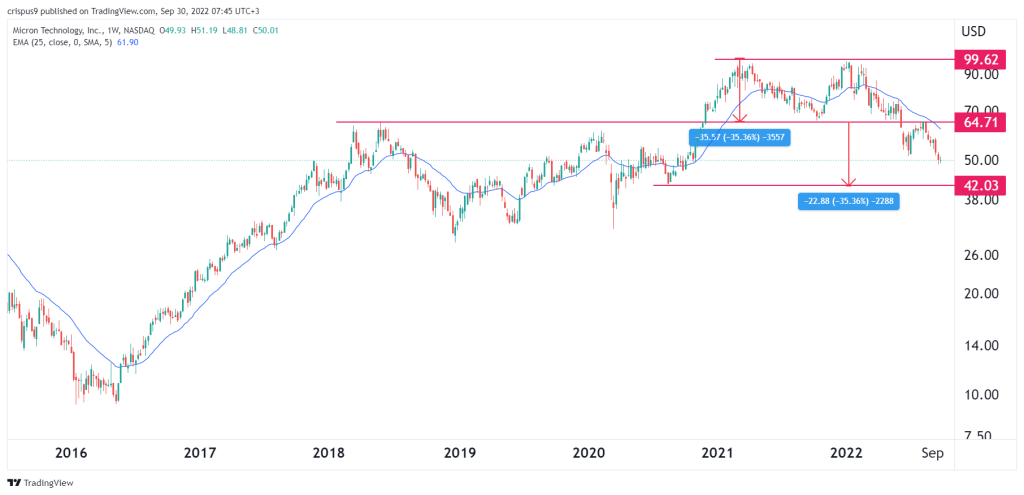

The weekly chart shows that the Micron stock price formed a double-top pattern at around $100. In price action analysis, this pattern is usually a bearish sign. It has managed to move below the neckline of the double-top at $64. It has also crashed below all moving averages while the Relative Strength Index (RSI) has continued falling.

Therefore, by measuring the double-top pattern, we can estimate that the MU stock price will continue falling. If this happens, the next key support level to watch will be at $42, which is notable since it was the lowest level on August 10. A move above the resistance at $60 will invalidate this view.