The Lloyds share price has slipped into negative territory this Monday after losing initial gains. The Lloyds share price did not positively respond to the latest Bank of England rate hike, unlike before when the 25 bps rate hikes by the BoE elicited demand from traders.

Despite the 50 basis points move to the upside, the UK’s apex bank has warned of a long recession. This pessimistic outlook seems to have soured the sentiment around UK banking stocks this Monday. The bank could also see some pressure as the BoE plans to start offloading the UK gilts it bought during the pandemic as part of its QE program.

Lloyds Bank is offering a tender to repurchase the 750 million pounds 7.625% notes which are due in 2025, with settlement to be provided on 16 August. The Lloyds share price has had an underwhelming year so far. Its 51-week price change currently stands at -3.2%.

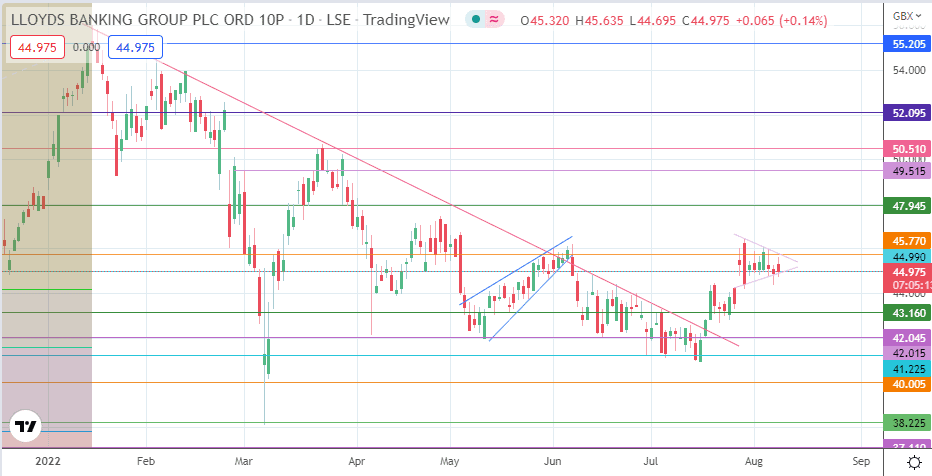

Lloyds Share Price Forecast:

The active daily candle is testing the lower edge of the symmetrical triangle formation on the daily chart and the 44.99 support level. A breakdown of these two support tools creates a pathway towards the 44.00 psychological area initially (28 June high) before the 43.16 pivot enters the picture as another downside target.

Additional support targets are at 42.045 (17 June and 18 July lows) and 41.225 (30 June low). 40.005 completes the short-term targets for the Lloyds share price bears. Conversely, a breakout from the triangle to the upside sets up the potential for a measured move that targets the 47.945 resistance (14 March high/29 March low).

Above this level, the highs of 1 March and 21 March 2022 form an additional upside target at 49.515. If the bulls uncap this barrier, the 50.15 price resistance formed by the previous high of 23 March becomes an additional target to the north. The 7 January low and 18 February high nestle at 52.095. This is the target to beat if the price advance clears the 50.15 barrier.