The Lloyds share price appears set for a second day in the red, as it is down 0.78% as of writing this Thursday. Recently, some news has cast a negative pall on UK banking stocks, starting from Barclays Bank’s bond trading loss in the UK and the sale of a chunk of the UK government’s stake at Natwest.

Lloyds’ bank has also been cited for several regulatory failings after the UK competition watchdog said a 2017 retail banking order was breached by the bank ten times. The fundamental trigger for Thursday’s downside was the report that the bank was set to close 60 branches in the UK this year.

Many UK banks have gone this route, as increased digitalization of banking operations and the costs from the COVID-19 pandemic have forced in-house reorganizations on a large scale. Last year, Lloyds marked 44 branches for closure after 56 branches were handed the same fate in June 2020.

The bank has defended the decision, with group retail director Vim Maru saying that fewer customers are visiting branches physically. The bank says it is seeing an uptick in its online platform and mobile app usage, with 15 million out of its estimated 18.6 million customers using the mobile banking app. The Lloyds share price has recently come off lows around 38p, climbing as highs as 50.69p on 23 March before the recent correction.

Lloyds Share Price Outlook

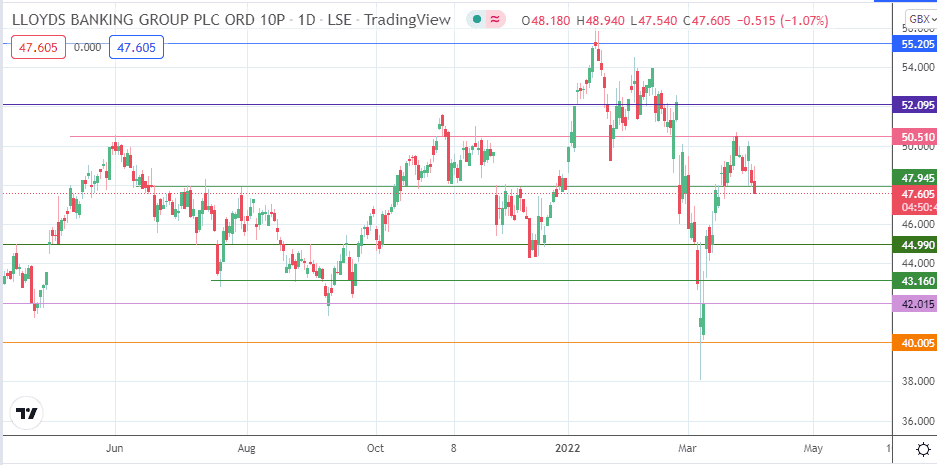

The intraday decline and the attendant violation of the 47.945 support level have put this pivot under pressure. A breakdown of this level opens the door for a run to the south, targeting 44.90 (5 October/20 December 2021 lows). The 46.00 psychological support could be a pitstop. If the decline continues, 43.160 (20 July/24 August 2021 lows) becomes an additional target to the south. Only when this new support is degraded can 42.015 enter the mix as another downside target.

On the flip side, the bulls would be hoping for a strong defence of the 47.945 support, prompting a bounce that targets 50.510 initially. This resistance barrier, where the 22 November 2021/23 March 2022 highs reside, will need to be uncapped by the bulls for 52.095 to become available. 55.205 is a multi-month resistance barrier that becomes a viable target if there is a break of 52.095.

Lloyds’: Daily Chart

Follow Eno on Twitter.