Lloyd’s share price closed yesterday’s trading session down by less than a percentage point. The drop was an extension of the previous four days that had also seen the company going down.

In the early hours of today’s trading session, Lloyds share price looks to be continuing with its strong and aggressive push to the downside. The recent drop pushed the share price down by 10 per cent year-to-date, despite the company having a strong month in July, which saw it close the markets by almost 7 per cent.

Unsurprisingly, the factors that have caused the company’s share price to drop throughout the year are still strongly influencing the company’s share price 8 months down the line. One of these factors is the ever-increasing inflation in the UK. The latest data shows UK inflation has crossed the 10 per cent mark. Forecasts also show that the inflation rate may go as high as 18 per cent by next year.

Normally, when there is a high inflation rate, the government increases the interest rate to slow down spending, which also slows economic growth. This impact on banks is fewer people willing to take out loans. There is also reduced financial activity due to the high cost of living and high-interest rates. All these factors combined can result in banks taking a hit in the markets.

On the flip side, banks such as Lloyds benefit from huge profit margins from people who decide to take out loans. This is because they charge more than they would normally.

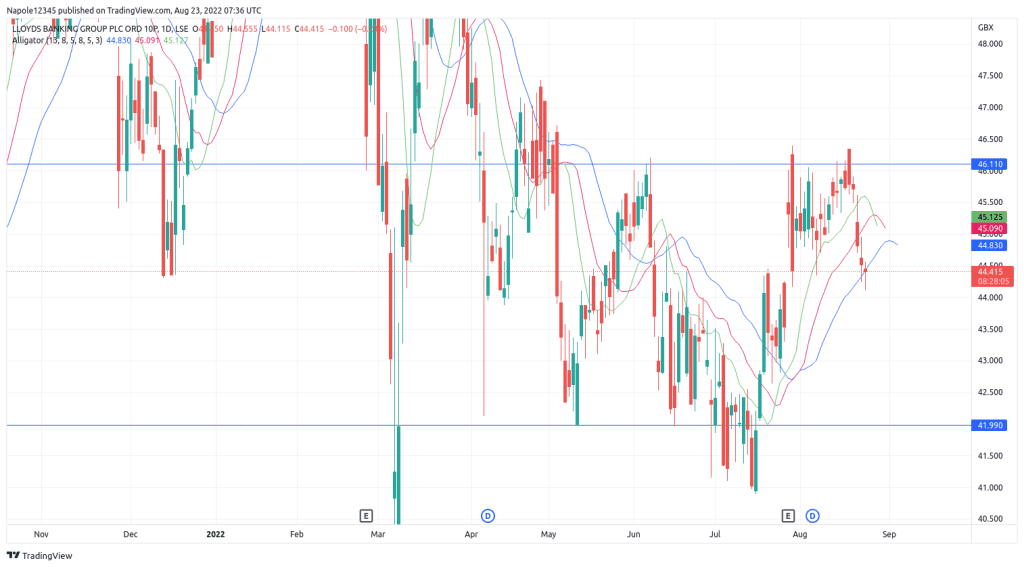

Lloyds Share Price Analysis

With inflation rates continuing to rise and bank interest rates, my Lloyds share price prediction expects the prices to continue dropping throughout the session. We are highly likely to see prices dropping to trade below the 42p price level in the next few trading sessions.

A drop below the 41.9 demand level is also possible, based on the current strong and aggressive push to the downside. My analysis will only be invalidated by prices trading above the 46.1 supply level.

Lloyds Daily Chart