The Knights share price looks set to end the week lower after a negative end to the day’s trading in London. The stock is down 4.86% to the week, resuming a slide after last week’s 9.67% recovery.

The talking point for the stock is the calamitous 50.28% plunge on 22 March after its lowered forward guidance. The company cut its revenue forecast due to the impact of the Omicron variant of COVID-19 on its business. Prior to the steep slump, the stock had been trading in above the 350.0p mark, but had been in a side range for several months.

The acquisition of UK law firm Langleys Solicitors for $15million has done little to stem the slide in the stock. The buyout was first announced on 31 January 2022 and follows that of Archers Law Firm, which it acquired for $7m in 2021.

The deal for Archers Law firm was paid for with a 2.1million pounds cash advance, and 1.6 million pounds worth of Knights stock. A deferred cash payment of 1.5million pounds will be made in three tranches over the next three years. The firm is hoping that the acquisitions will enable it consolidate its business and improve its earnings.

What does the 2nd quarter hold for the Knights’ share price?

Knights Share Price Outlook

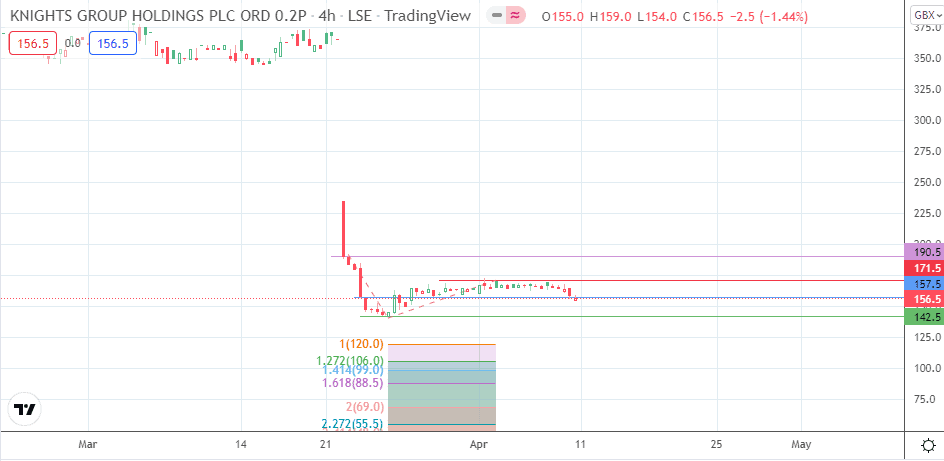

After trading in a tight range formed by the 171.5 resistance and the 157.5 support, the active 4-hour candle has broken below the range floor and is now trying to force a return to the rectangle. The broken floor is expected to act as a new resistance to this move. If the bears resist the return move, it could favour a push towards the 24 March low at 142.5. A breakdown of this pivot sends the Knights’ share price to new record lows. 120.0 and 106.0 (100% and 127.2% Fibonacci extension levels) are additional price levels to the south, resulting in new support levels.

On the other hand, a return above the 157.5 price mark sends the price back into the range. The bulls would then need to push the price above the 171.5 resistance to bring in a new potential barrier into the picture. The 190.5 resistance is this new target, above which the bulls would need to seek price discovery between this level and the 22 March high at 235.0.

Daily Chart