It has been a painful winter for cryptocurrency investors since bitcoin topped out just below 70k last November. Whether you look at the market as a whole, bitcoin in isolation, the market excluding bitcoin, or individual names further down the market cap rankings, you get the same picture of a bear market that has dragged all crypto assets down from their recent speculative highs.

From peak to trough, bitcoin was down over 50% from its November highs, with Ethereum, Tezos, and Cardano down 55%, 71%, and 75%. The extent of the sell-off has many traders wondering whether the bottom is in for the moment and whether crypto may be ready for a new move higher.

It’s worth noting that the sell-offs have been far more extreme in previous bear markets. For example, in 2018’s bear market, bitcoin gave back 84% from peak to trough, while ether was down over 95%. Before that, the bear market saw bitcoin giving back over 86% of its gains between 2013 and 2015. Of course, ether didn’t exist back then, so we have no basis for comparison, but Ripple (XRP) did, and it fared similarly to ether in 2018, down 95% during the bear market of 2013-2015.

The longer bitcoin has been around, the less extreme its drawdowns have become. Projects like Ripple and Ethereum have provided crypto with a risk curve, where these more speculative crypto assets bear the brunt of the sell-off when risk tolerances drop. As these projects gain traction and grow, they also start behaving more like bitcoin, as evidenced by ether being far less volatile between 2020 and 2022 than between 2017 and 2018.

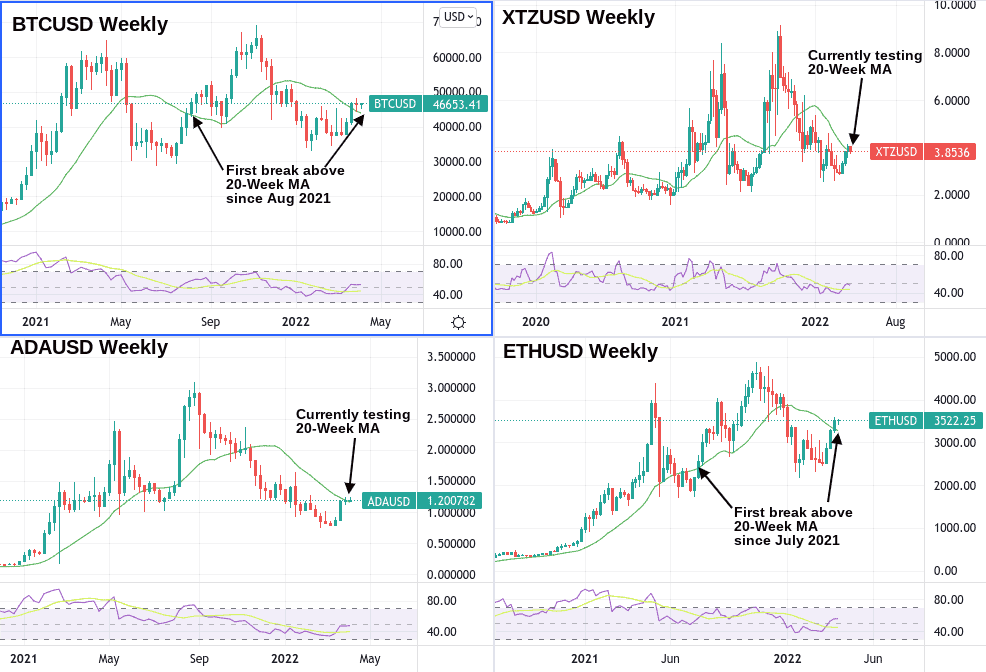

Where does this leave us? According to the charts, it leaves us where we were in August of 2021. Bitcoin recently climbed above the 20-week moving average for the first time. The week after, it was followed by ether, and now the rest of the crypto market appears to be trying to clear this historically important moving average. Suppose the price history is anything to go by. In that case, we can expect a multi-week rally from here if bitcoin remains above the 20-week, setting the stage for more speculative assets to outperform it in percentage terms before it retreats to the 20-week and brings the entire market back down to earth again. So keep an eye on that 20-week MA.

Cryptocurrency CFDs are available for trading at HYCM and other instruments in forex, commodities, stocks, and indices.