HSBC share price (LON: HSBA) has been one of the best performers among global banks for the last 3 years. Since 2020, HSBC stock has soared by 115% due to increasing inflation and the recent rate hikes. Our analysis shows that the price still has a lot of room to grow.

HSBC bank is the largest European bank in terms of total assets worth north of $3 trillion. The latest financial reports from most UK banks like Lloyd and Barclays have shown a massive increase in profits. This is a result of constant rate hikes in 2022, which are likely to continue this year.

HSBC Bank Lates News

Recently, HSBC bank released its Q4 2022 earnings report. According to this report, the firm reported a pre-tax profit of $5.2 billion during Q4 2022. This was a year-over-year increase of 108%. The figure also beat the bank’s own estimates of $4.97 billion in pre-tax profits.

The annual revenue of the financial giant also increased from $49.55 billion to $51.73 billion. These figures were taken well by the market as HSBC share price increased in the following days. On Thursday, LON: HSBA opened lower and slid even further. At press time, the price is trading at 617p after losing 3.17%. FTSE 100 index is also trading lower after showing minor losses since yesterday.

HSBC Share Price Forecast

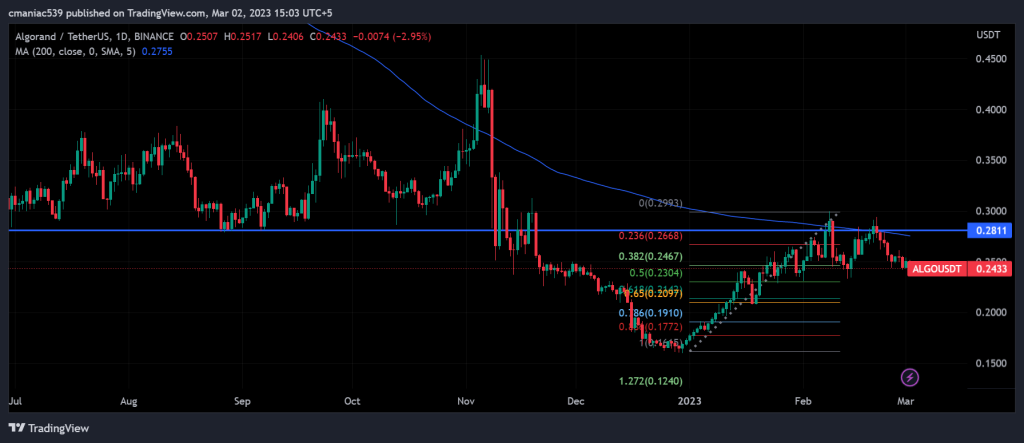

On the weekly and daily timeframes, HSBC stock is still bullish as it is maintaining an uptrend. The price has constantly been making higher highs and higher lows since 2020. Today’s correction comes as no surprise as the price is retesting the 0.618-0.65 Fib golden pocket. If the price gains strength above this level, then bulls may target 766p in the next couple of months.

This HSBC share price prediction seems quite appropriate considering the upcoming rate hikes. Most analysts are expecting at least another 100 basis points increase from US Federal Reserve. This, together with rate hikes from the Bank of England, will put upward pressure on bank shares.