Hotel Chocolat share price has collapsed to a record low as investors worry about the company’s growth. HOTC shares have dropped in the past ten weeks, meaning that the stock has dropped by more than 76% from its all-time high. This collapse has brought its total market cap to just £182 million.

Hotel Chocolat collapse continues.

Hotel Chocolat is a leading company in the gifting industry. The firm manufactures and sells chocolates in 150 stores in the UK, Japan, and the United States. It also has a farm in Saint Lucia, where it grows its cocoa. In addition to chocolates, the company sells coffee and alcohol. It also has an online subscription service whose price ranges from £13 and £62.

Hotel Chocolat share price has come under intense pressure in the past few months as investors worry about the slowing growth and rising cost of doing business. However, last week, the firm said that its full-year revenue rose by 37% to £226 million.

While the result was better than expectations, its guidance was significantly lower than what analysts were expecting. The company also hinted that it will make a statutory loss in the full year. It is also well capitalised, with about £17 million in cash and about £50 million in undrawn liquidity. The firm’s CEO said:

A year of exceptional sales growth following two years of reactionary tactics to the pandemic has left clear opportunities for us to proactively streamline overheads and improve gross margins.”

Said the firm’s CEO

The Hotel Chocolat share price performance will likely attract buy-the-dip investors. From a fundamental perspective, the company has a strong and growing market share in the UK, Japan, and the United States, which is a positive factor.

At the same time, I expect that the cost of commodities like cocoa will fall in the coming months. Lower cocoa prices and potentially higher product prices will likely be positive for the company.

At the same time, the firm’s valuation has become relatively cheap, considering it is trading at a 12x multiple. Another potential catalyst is that the company could become an acquisition target by a larger confectionary or a private equity company.

Hotel Chocolat share price forecast

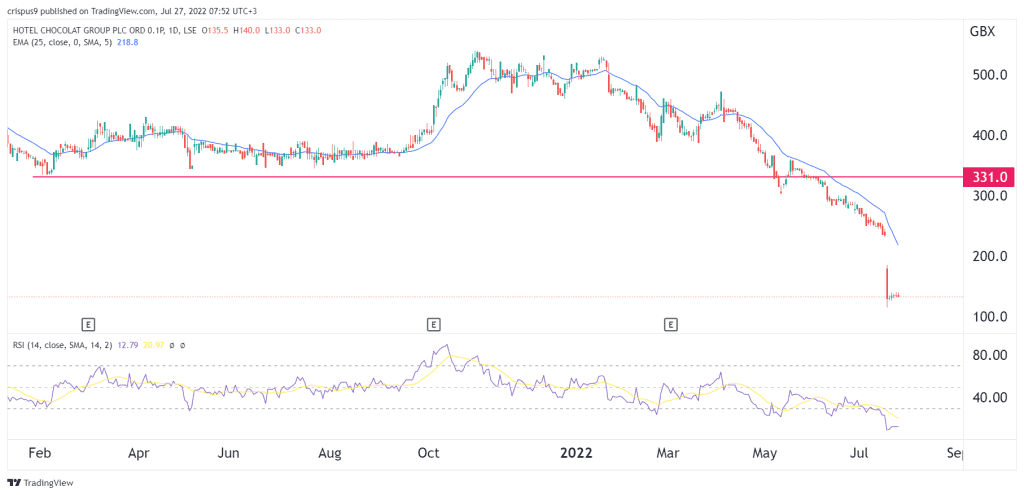

The daily chart shows that the Hotel Chocolat share price has been in a strong bearish trend in the past few months. The sell-off gained steam when the stock fell below the important support level at 331p, where it struggled to move below in 2021. In addition, the shares remain below all moving averages while the Relative Strength Index (RSI) has moved to the extremely oversold level.

Therefore, the outlook for the stock is bearish, meaning that it will drop to below 100p. However, in the long-term, a rebound will be possible since the firm has a good balance sheet and demand is expected to keep rising.