The Tullow Oil share price strong recovery has fizzled amid the relatively volatile crude oil prices. The stock is trading at 44.25p in London, which is about 33% below the highest point this year. Still, the TLW stock has risen by more than 40% this year and outperformed supermajors like Royal Dutch Shell (RDSB) and BP.

Volatile oil prices and Tullow

Tullow Oil and Gas is an independent exploration and mining company that focuses mostly on the African continent and South America. The company has operations in countries like Kenya, Ghana, Mauritania, and Cote d’Ivoire.

As such, since these companies have little experience in the sector, the company tends to face substantial challenges. Some of these challenges are infrastructure and revenue sharing formulas among the locals.

Tullow Oil does well when oil and gas prices are in an upward trend. Indeed, in the first half of the year, the company produced about 61,200 barrels per day. The company also managed to refinance its debt by issuing about $1.8 billion of Senior Secured debt. It also sold its business in Equitorial Guinea and launched a technical study about its Kenya operations.

Tullow expects that urs total capital expenditure will be $250 million this year. It also expects that its total cash flow will be about $600 million provided that oil remains at $60. As such, with oil currently trading at $70, there is a possibility that the company will report strong results.

Tullow Oil is one of the most popular FTSE 250 stocks. It is often in the trending zone that is usually monitored by Hargreaves Lansdown. Today, the stock will likely remain under pressure considering that crude oil prices have declined by more than 1%.

Tullow Oil share price forecast

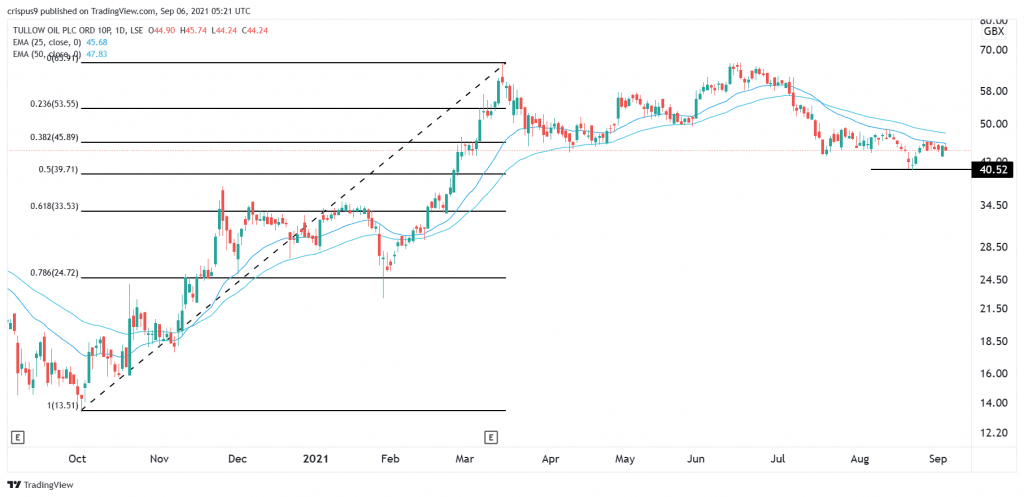

The daily chart shows that the TLW share price rose to a year-to-date high of 66p earlier this year. Since then, the stock has declined and moved below the 38.2% Fibonacci retracement level. It has also moved below the 25-day and 50-day moving averages. The stock is hovering above the August low at 40.52p.

Therefore, the overall outlook of the Tullow stock is bearish. This view will be confirmed if the stock manages to decline below 40.52p. If this happens, the next key level to watch will be the 50% retracement level at 39.70p. On the flip side, a move above 46p will invalidate this view.