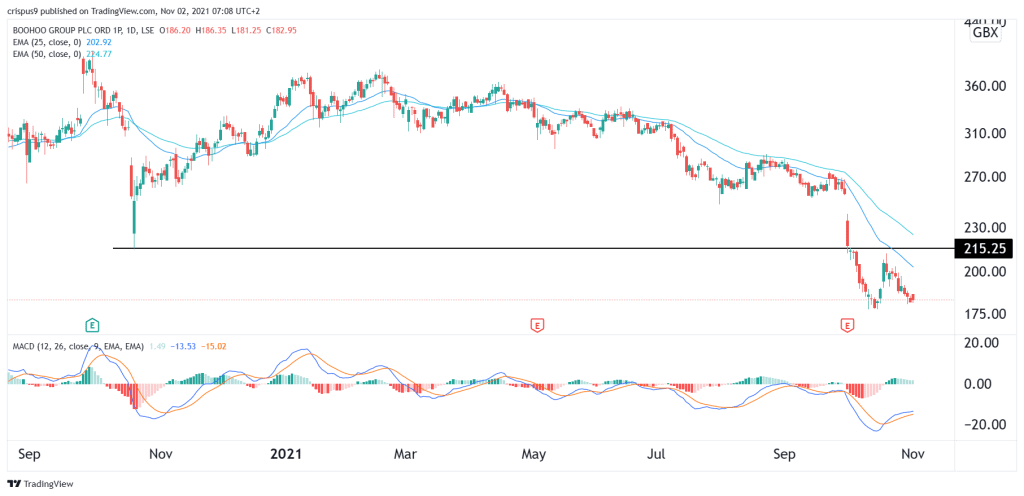

The Boohoo share price intense sell-off is accelerating. The BOO stock has fallen in the past four straight days and is trading at 182p. This price is about 13% below the highest level on October 19th. It has also fallen by more than 50% from its highest level this year.

Why BOO has struggled

There are several reasons why the Boohoo share price has struggled in the past few months. First, the company is facing significant competition from fast-rising companies like Shein. The company, which is expected to go public soon, has a valuation of more than $5 billion.

Second, Boohoo is facing rising cost of doing business. For one, the price of cotton has risen to the highest level in more than 10 years. This makes its cost of producing clothes to rise substantially. At the same time, the logistics challenges have continued rising, making it more expensive for the firm to ship its products. The firm is also paying more to get workers.

Third, the company decided to lower its guidance in September. The company said that it will make less money than it had guided before. It said:

“Performance in the second quarter was impacted by UK returns rates returning to pre-pandemic levels, physical stores reopening, consumer uncertainty in markets that we operate in resulting in the loss of key events and holidays.”

Still, analysts believe that the Boohoo share price is currently at a sweet spot. Besides, the stock has been in a significant sell-off in the past few weeks. For example, analysts at Deutsche Bank initiated their coverage with a buy rating.

At the same time, those at Berenberg believe that the stock could rise to 350p, which is significantly higher than the current 182p. Those at Royal Bank of Canada see the stock rising to more than 400p.

Boohoo share price forecast

The daily chart shows that the Boohoo share price has been in a strong bearish trend in the past few months. Interestingly, the stock seems to be forming a double-bottom pattern at 178p. A double-bottom pattern is usually a bullish sign. Its chin is currently at October 19th high of 210p.

Therefore, while the stock is currently extremely bearish, there are signs that it is bottoming. This means that a bullish rebound cannot be ruled out.