Manchester United stock price surged to the highest point since June 1 as investors priced in a potential bid for the company. As a result, MANU share price soared to a high of $12, which was about 23% above the lowest level this year. However, the shares are still about 40% below the highest point in 2021, valuing the club at over $2 billion.

Will Man U be acquired?

Manchester United has been under pressure in the past few years as the club has struggled in the English Premier League (EPL). The club has not participated in the European league for years. As a result, the company’s revenue has been on a downward trend.

It dropped from a high of $757 million in 2017 to $683 million in 2021. The company has also moved to a loss-making territory as its losses mounted to $200 million in the past 12 months. In the most recent quarter, the company said its total revenue was $152 million, up from the previous $118 million. Its adjusted EBITDA rose to $20.4 million.

The Manchester United stock price has rebounded in the past few weeks as investors react to rumours of a potential hostile takeover offer. Recently, Michael Knighton said that he had formed a consortium in a bid to acquire the club.

Remember, it is a hostile bid – that simply means that the club isn’t officially for sale. But my intention is to present these owners with a legitimate, potent and commercial offer to say: ‘You have run out of road, it’s time to go, because your time is up.'”

said Knighton

The stock also reacted to a joke by Elon Musk about acquiring the club. He then reiterated that he was not buying the club. Football clubs in Europe have seen a lot of interest lately. Saudi Arabia acquired Newcastle for $409 million. Chelsea was recently acquired by a team led by Todd Boehly for over $5.3 billion.

Manchester United stock price forecast

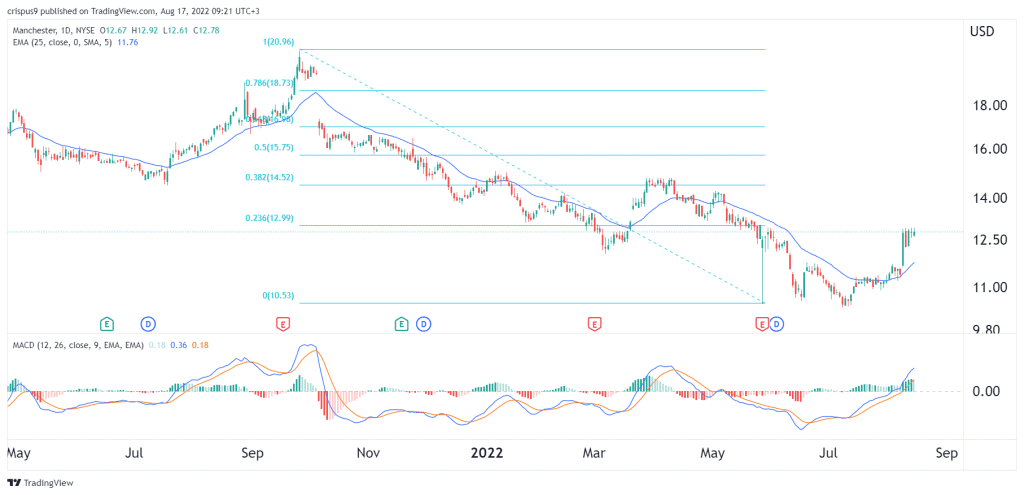

The daily chart shows that the Man U stock price has been in a downward trend in the past few months. This sell-off saw the shares drop to a low of $10. The stock has recently bounced back as investors price in a potential bid for the company. As it rose, it crossed the 25-day and 50-day moving averages. The MACD has moved above the neutral point. It is also approaching the 23.6% Fibonacci Retracement level.

Therefore, the Manchester United stock price will likely continue rising as investors wait for the upcoming bid. If it comes, the shares could rise to the next key resistance level at $16, which is the 50% Fibonacci Retracement level. A move below the support at $12.30 will invalidate the bullish view.