Gold price action on the XAU/USD chart suffered a second day of selling, as the US Dollar gained traction on the day.

First seen immediately after the Reserve Bank of Australia extended its bond-buying program, broad-based USD strength got extra traction from a rise in the US long-term bond yields. Rallying US bond yields causes investors to seek higher yields on the greenback against the non-yielding yellow metal.

Gold price is down 1.49% as of writing and is pushing hard towards the nearest support at $1789.

Gold Price Outlook

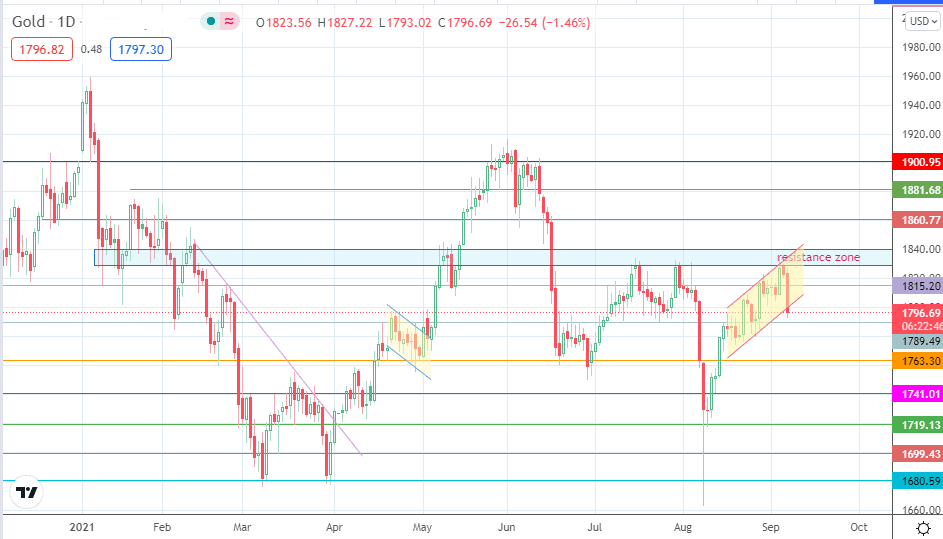

Tuesday’s selloff has breached the 1815.20 and 1800.00 support levels, aiming for the next support target at 1789.49. This move needs to breach the channel’s lower border that encased price action for the last three weeks for completion to occur. Below this level, additional targets lie at 1763.30 and 1741.01.

On the flip side, upside targets at 1860.77 and 1881.68 will only come into the picture if the gold price breaks past the most recent resistance at the 1828/1840 resistance zone. This move needs to acquire upside traction from either the 1789.49 support level or the 1800.00 psychological price mark if the price ends above this level.

Gold Price (XAU/USD): Daily Chart

Follow Eno on Twitter.