Gold price has fallen relentlessly in the past few days as king dollar reigns supreme. It has crashed to a low of $1,880, which is the lowest it has been since February 24 this year. Moreover, the price has retreated by almost 10% from its year-to-date high. Similarly, the silver price has tumbled by over 14% from its highest point this year and is trading at $23.19.

Gold price soared to a high of $2,070 earlier this year after Russia invaded Ukraine. At the time, the price of most commodities, including copper, crude oil, and natural gas, surged. However, these commodity prices have recently retreated as concerns about the strong US dollar remain. Indeed, the US dollar index has surged to $102, which is the highest it has been since 2020.

As a result, gold has an inverse relationship with the US dollar in most periods. The biggest concern among gold investors is the Federal Reserve. In the past few days, most Fed officials have warned about the need to tighten monetary policy faster, considering that inflation is rising.

Some analysts warn that these rate hikes and quantitative tightening could lead to a recession. In a note this week, analysts at Deutsche Bank warned that rates could rise to between 5% and 6% and then push the country to a recession. The views happen as the yield curve inverted to the lowest level in over 13 years.

Gold price prediction

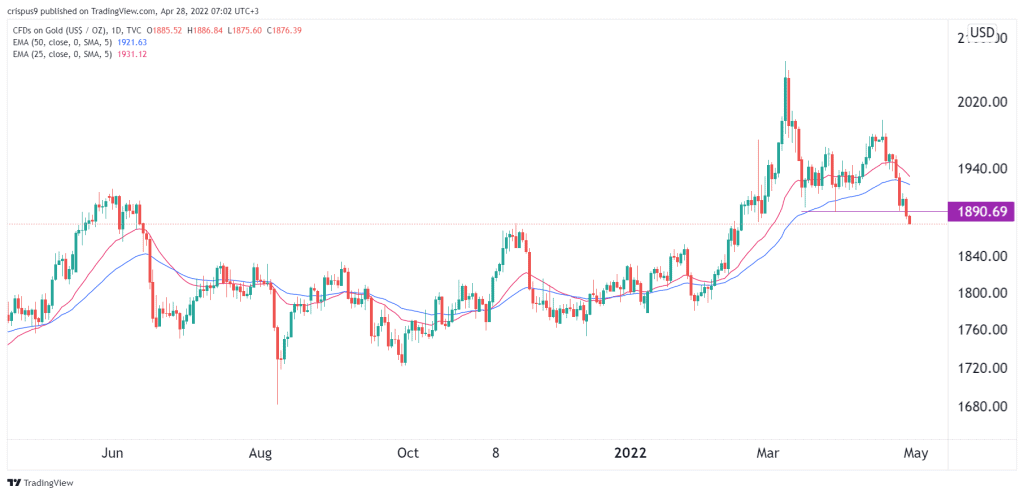

The price of gold has dropped sharply in the past few weeks. It has fallen in the past two straight days and is now at the lowest level since February 17th. In addition, the metal has moved below the important support level at $1,890, which was the lowest level on 29th May. Further, gold has dropped below the 25-day and 50-day moving average while the Relative Strength Index (RSI) has moved downwards.

Therefore, the path of the least resistance for XAU/USD is lower, with the next key support being at $1,800. A move above the key resistance at $1,890 will invalidate the bearish view.