The Glencore share price has taken a breather on the day, as traders take some profits from the recent bullish moves on the stock.

Apart from the stock’s stellar performance in 2021, which was driven by recovering metal prices, the stock has also seen demand from recent acquisitions it has made. The company has completed the purchase of the Cerrejon coal mine in Colombia from its other joint venture partners BHP and Anglo-American. The company has also reached an agreement with Merafe Resources to form a joint venture which will build a new platinum production plant at the Kroondal mine in South Africa.

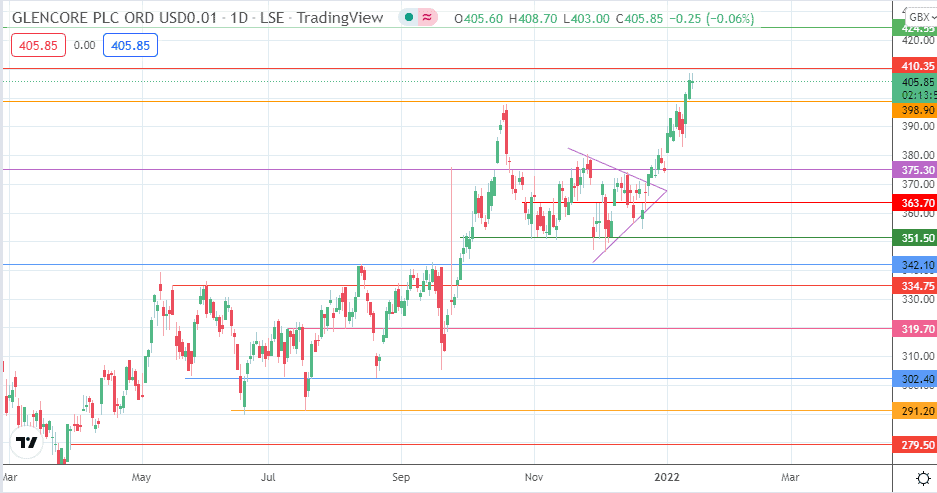

These fundamentals have spurred the uptrend, which kicked off from a break of the symmetrical triangle on 22 December. The resultant move also formed a bullish flag along the way and led to a measured move which is about to hit completion at 410.35.

Glencore Share Price Outlook

The intraday decline has temporarily halted the march towards 410.35. However, the bullish trend means that there may be a renewed push towards this resistance. A break of this level opens the door to the previous high of 16 April 2012 at 424.55. 440.0 is a psychological price level that serves as the next target, achieved on 30 April 2012.

On the flip side, rejection at 410.35 allows for a corrective, which tests 398.90 initially. If the bulls leave this level undefended, 375.30 and 363.70 will serve as additional price levels to the south.

Glencore: Daily Chart

Follow Eno on Twitter.