GBPUSD started the European trading session muted ahead of the Fed monetary policy decision late on the day. British pound outlook has improved this week after the heavy losses suffered the previous week helped by better U.K. jobs data. The developments in Brexit negotiations will continue to dominate the pair as we approach the October deadline set by Boris Johnson

UK Inflation Slowed Down In August

UK Consumer prices slowed down to 0.2% in August, compared with a rise of 1.0% in July. Analysts expected CPI at 0.0% in August. Core Consumer Price Index registered in at 0.9%, topping the expectations of 0.6%. The U.K. Retail Price Index came in at 0.5%, below the forecasts of 0.6%.

The Producer Price Index – Output came at 0% in August below the estimates of 0.2%. The Producer Price Index – Input reported at -0.4%, below the forecasts of 0.3%.

All Eyes in Fed Today

The Federal Reserve will conclude today the last policy meeting before the U.S. election in November and the first since the shift in its policy framework. Analysts expect the Fed to keep its monetary policies unchanged. The focus will be on the fresh economic projections for growth, employment, inflation, and possibly forward guidance in interest rates. I expect high volatility in the markets during Jerome Powell’s press conference as he will discuss the economic projections.

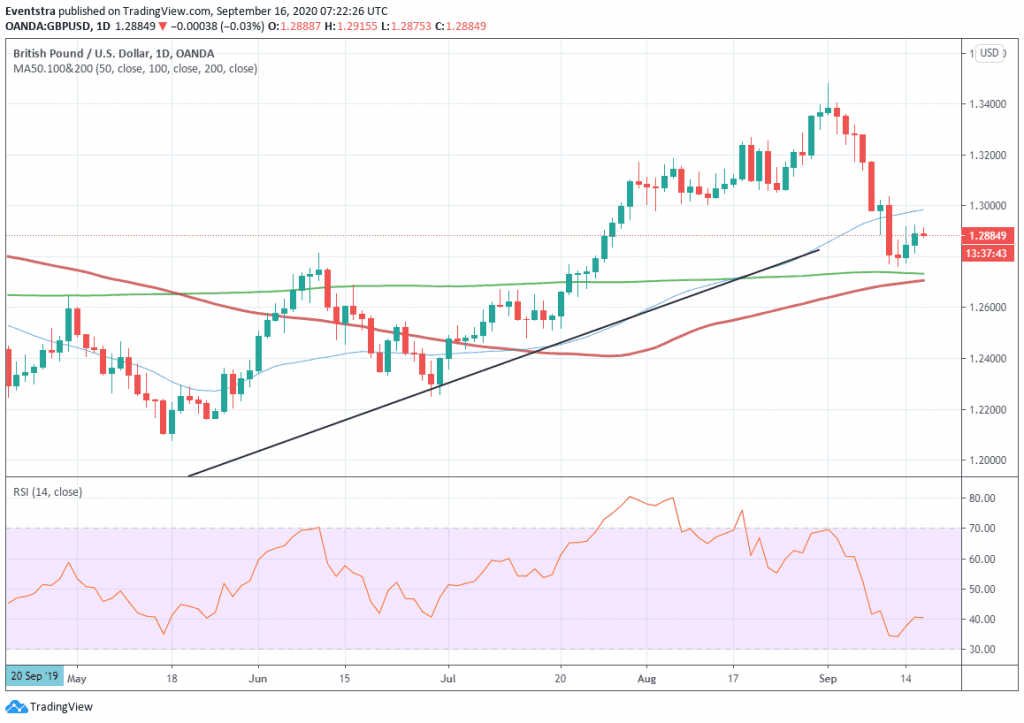

GBPUSD Price Daily Technical Analysis

GBPUSD is 0.04% lower at 1.2883, waiting for fresh clues from the Fed policy meeting. GBPUSD found support at the 200-day moving average and managed to rebound from two-month lows.

The first resistance for GBPUSD stands at 1.2984 the 50-day moving average. Next hurdle for the GBPUSD pair would be met at 1.3171 the high from September 8. More sellers would emerge at 1.3279 the top from September 7.

On the downside, initial support is at 1.2817 the low from September 15. Bears need to break below the 200-day moving average at 1.2733, which guards the 1.27 mark and the 100-day moving average.

Don’t miss a beat! Follow us on Telegram and Twitter.

GBPUSD Daily Chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Nikolas on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.