The GBPUSD price action continues to improve following the BoE’s interest rate hike as traders grow increasingly bullish.

Cable is trading at a three-week high of $1.3382 (+0.20%) early Thursday, firmer by +1.5% from the 2021 lows set earlier this month. Although, the recent strength is in some part due to the Bank of England’s tightening measures, the weaker greenback is playing its part. Risk assets are back in play this week as fears over the Omicron virus strain are fading. As a result, the dollar has lost the safe-haven bid seen earlier in December.

Data from IG index shows that 78% of retail traders are net-long USDGB pair, the highest reading since September 30th. In my opinion, increasing retail exposure should encourage the Pound higher in the near-term. However, one-sided trades often end in reversal. Therefore, gains may be limited moving further down the line.

Sterling Price Forecast

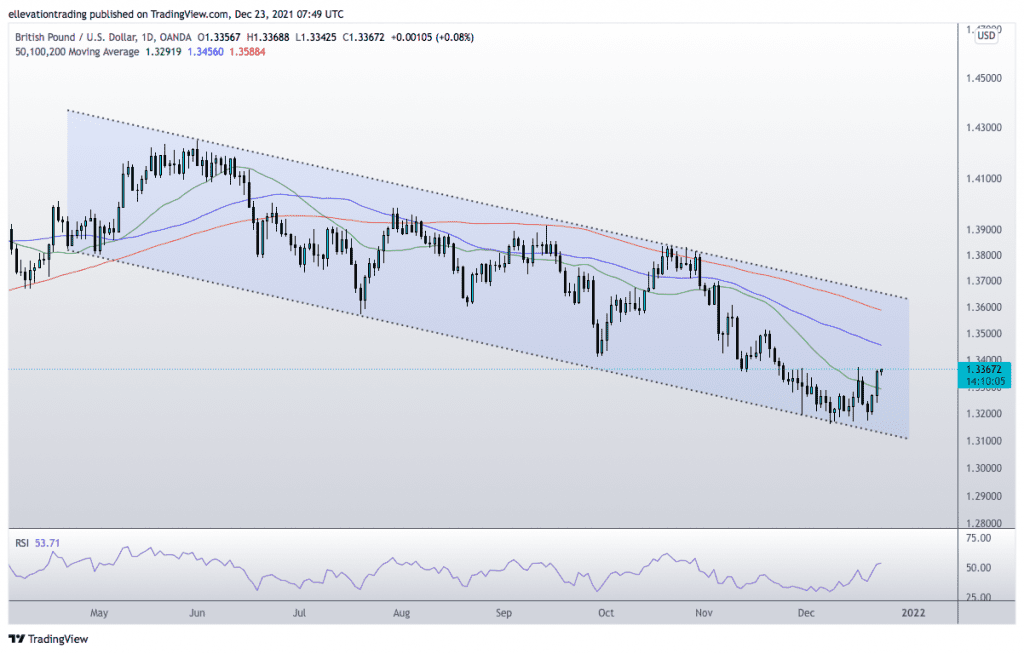

The daily chart shows the GBPUSD price closed above the resistance (now support) of the 50-Day Moving Average on Wednesday. Furthermore, the Relative Strength Index reading of 54, highlights the strong bullish momentum.

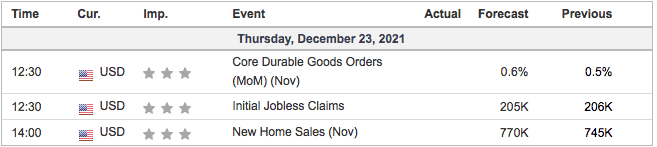

A logical near-term target is the 100-DMA at $1.345, which I expect to be tested in the coming sessions. However, the US Core Durable Goods, Initial Jobless Claims and New Home Sales data for November later today are all potentially impactful.

A daily reversal below the 50-DMA would suggest the recovery is breaking down. On that basis a daily close below $1.3291 invalidates the bullish view.

GBPUSD Price Chart (daily)

For more market insights, follow Elliott on Twitter.