The GBPUSD pair is up slightly as traders remain concerned about Brexit issues and the upcoming central bank meetings. It is trading at 1.2835, which is a few pips above last week’s low of 1.2758.

The biggest challenge for the GBPUSD pair is about Brexit. Last week, talks between the United Kingdom and the European Union ended without a deal. At the same time, a decision by the UK to pass an internal markets bill has irked the EU, making it almost impossible for the two sides to reach a deal. Fortunately, some conservatives and the US have opposed the bill, meaning that the bill could be changed.

This week, the GBPUSD will be in the spotlight as investors react to the Federal Reserve and Bank of England interest rate decision on Wednesday and Thursday, respectively. Analysts don’t expect major changes in policy from the Fed. However, while the BOE will leave rates unchanged, it will also possibly talk about measures it intends to put if the UK fails to reach an agreement with the European Union.

In addition to all these, the GBPUSD will react to vital economic data from the United Kingdom. Tomorrow, the ONS will release the country’s July employment data followed by inflation numbers on Wednesday. And on Friday, it will release the UK’s retail sales numbers.

GBPUSD technical outlook

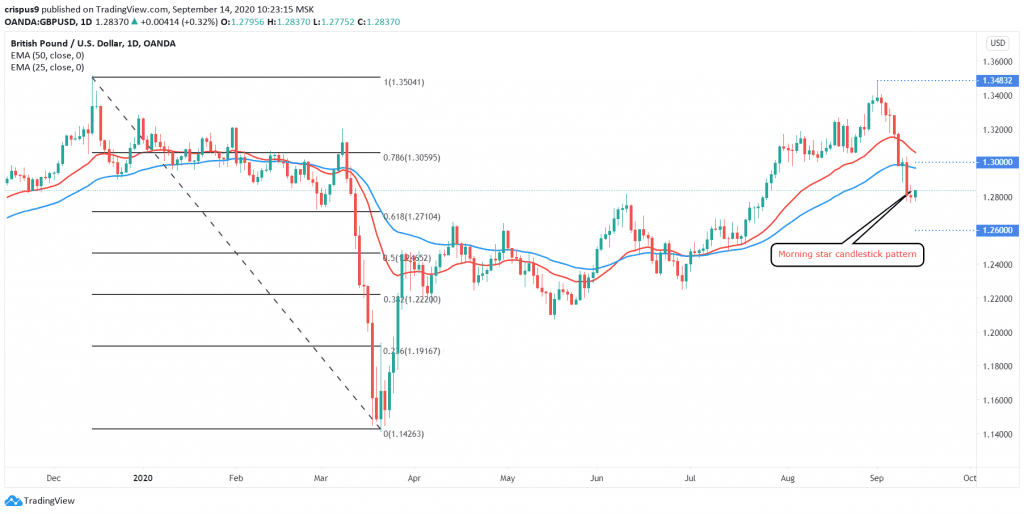

The GBPUSD pair is trading at 1.2835. On the daily chart, the price is slightly above the 61.8% Fibonacci retracement level. It is also still slightly above the 50-day and 100-day exponential moving averages. The price is rising, a day after it formed what seems to be a morning star candlestick pattern.

Therefore, while the overall trend remains lower, I suspect that the GBPUSD pair will continue rising today as bulls aim for the next resistance level at 1.3000.

On the other hand, a move below Friday’s low of 1.2758 will invalidate this short-term trend. It will mean that there are still sellers in the market, who will be keen to push the pair lower.

Do you want to be an excellent trader? Register for our free forex trading course and one-on-one coaching by traders and analysts with decades of experience in the industry.

Don’t miss a beat! Follow us on Telegram and Twitter.

GBP/USD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.