Pound is under heavy selling pressure today after a Bloomberg survey shows that the UK economy is forecast to have contracted in second quarter of 2019. That will be the first contraction in Great Britain economy since 2012. The projections are now for a 0.1% contraction, a downgrade from earlier prediction of stagnation, 0.0% in June. Earlier today the British Retail Consortium data for June came in worst than expected, down 1.6%, year over year for sales like-for-like. It was expected at -1.1%, year over year, while the previous reading was -3.0%.

Meanwhile the Irish finance minister noted that the prospect of disorderly Brexit is now a significant risk.

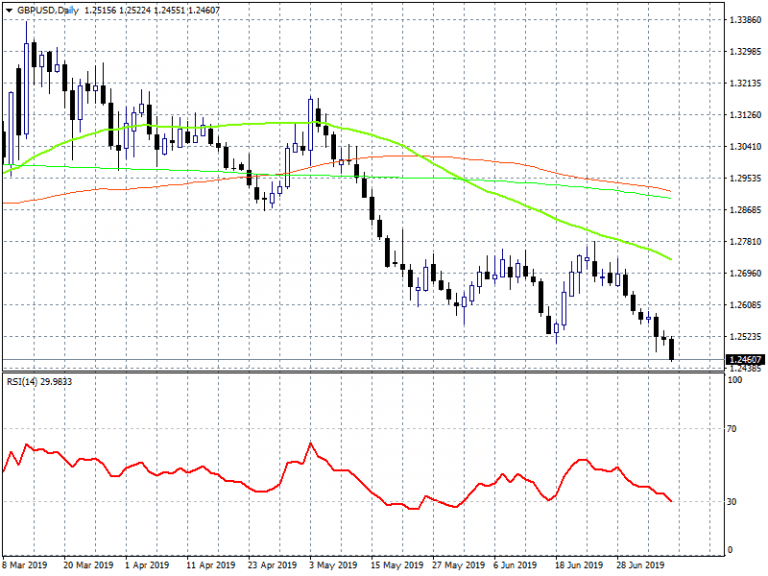

On technical side the bearish momentum persists as the pair trading below all the major hourly and daily moving averages. Support for the pair stands at today’s low at 1.2457 and then at 1.2395 the low from April 2017. On the upside immediate resistance stands at 1.2516 the 50 hour moving average and if the pair manages to close above it might continue with an attempt to 1.2547 the 100 hour moving average. The RSI have reached oversold levels so a sharp rebound can’t be ruled out.Don’t miss a beat! Follow us on Twitter.