The GBPUSD is up for the fifth straight day as traders continued to react to the Bank of England (BOE) and Fed interest rate decision. They are also reacting to the slightly better retail sales from the UK and the weak data from the United States.

According to the Office of National Statistics (ONS), the volume of trade sales rose by 0.8% in August compared with the previous month. That was slightly better than the 0.7% that analysts were expecting. It was nonetheless worse than the previous month’s increase of 3.7%.

It was also the fourth straight month that the sales have risen. Also, the volume of goods sold in retail stores and online stores rose by 2.8% from the same month in 2019.

Meanwhile, the GBPUSD is also reacting to the weak economic data from the United States. On Wednesday, data from the country showed that retail sales slowed in August. And yesterday, data showed that the housing starts and building permits also disappointed. That is partly because the supplementary $600 jobless claims funds expired in the final week of July.

Meanwhile, the GBPUSD is up slightly even after the Bank of England warned that negative rates were in play if the economy continued to weaken.

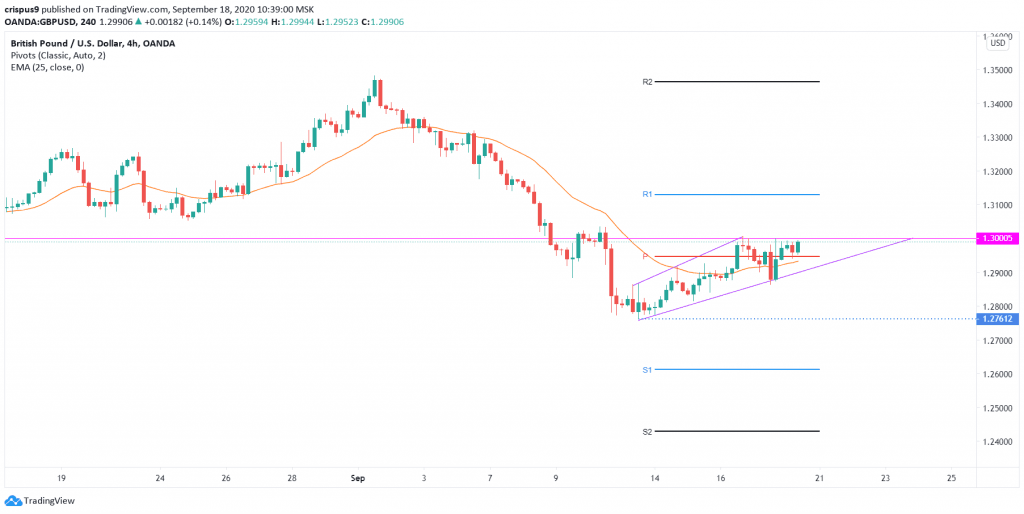

GBPUSD technical chart

The GBPUSD pair is trading at 1.2990. On the four-hour chart, this price is slightly above the 4-hour classic pivot line and the 25-day moving average. The price also seems to be forming a bearish flag pattern that is shown in purple. Also, the price is slightly above the important resistance level at 1.3000.

Therefore, I suspect that the current upward trend is not extremely strong, which means that the price is likely to resume the downward trend as bears attempts to move below the June low of 1.2761. On the flip side a move above the resistance at 1.3000 will invalidate the bearish thesis.

Don’t miss a beat! Follow us on Telegram and Twitter.

GBP/USD technical chart

More content

- Download our latest quarterly market outlook for our longer-term trade ideas.

- Follow Crispus on Twitter.

- Do you enjoy reading our updates? Become a member today and access all restricted content. It is free to join.