Contrasting data from the United Kingdom and South Africa have provided the basis for the surge in the GBP/ZAR currency pair seen on Wednesday. The GBP/ZAR is up 1.44% as the inflation in the UK crossed the 10% mark on an annualized basis, while retail sales in South Africa slumped.

Data from the UK’s Office for National Statistics indicate that the consumer price index in the UK (y/y) rose from 9.4% to 10.1% in July 2022, beating analysts’ forecasts of a 9.8% increase in consumer prices. The core component of the index (ex. food and energy prices) rose to 6.2% yearly, beating estimates of 5.9% and showing an increase of three percentage points above the previous number.

This has heightened the potential for an additional hike in interest rates by the Bank of England, which had predicted a 13.3% annualized inflation rate by the end of 2022. On the other side of the equation, retail sales in South Africa slumped in July by 2.5% yearly, compared with the previous month’s increase of 0.1% and the projected increase of 0.4%.

This dismal retail sales figure shows rising inflation’s impact on consumer spending in South Africa, triggering weakness in the Rand. Wednesday’s surge points to the playbook of the day on the pair based on divergent fundamentals for both currencies.

GBP/ZAR Forecast

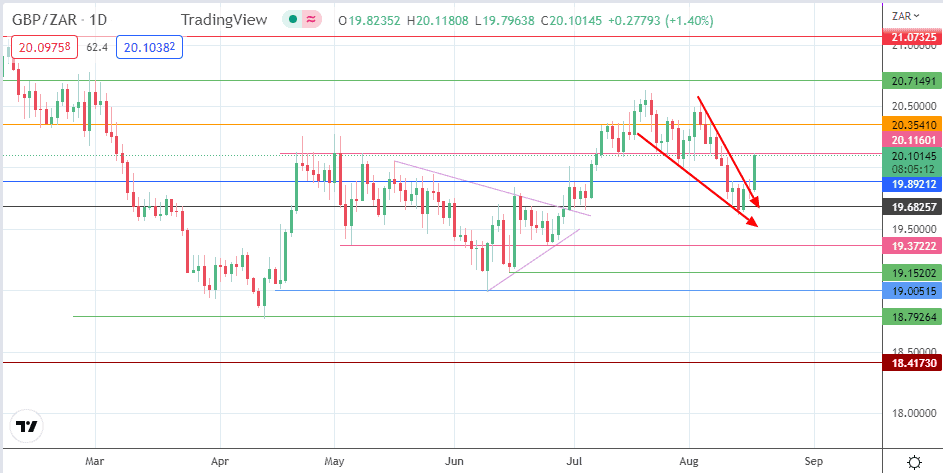

The active daily candle is currently challenging the resistance at 20.11601, formed by the previous highs of 21 April and 9 May and by the lows of 22 July/5 August 2022. This scenario comes as the day’s uptick broke the falling wedge’s upper border to complete the pattern.

A break above this level targets the pattern’s completion point at 20.35410. However, a continuation of the advance beyond this point must take out the recent highs of 20 July and 3 August to attain the 20.71491 price barrier, formed by the previous highs of 11 February and 1 March 2022. A clearance of this barrier restores the uptrend on the pair, targeting the 21.07325 high of 8 February 2022, followed by the 21.38962 price mark.

On the other hand, rejection at 20.11601 triggers a correction that aims for the 19.89212 support level (1 July/11 August high) initially, before 19.68257 comes into the mix on further price deterioration. The 5 May and 24 June lows at 19.37222 form an additional target to the south.

GBP/ZAR: Daily Chart