The GBP/ZAR price moved sideways after the recent strong consumer inflation data from the UK and South Africa. The pound to rand price is trading at 19.54, where it has been in the past few days. This price is about 2.97% above the lowest point in June this year.

South Africa and UK inflation

The South African rand has held relatively well against other developed and emerging market currencies. The GBP to ZAR price has crashed by more than 10% from its highest point in December last year. This strength is mostly because of the country’s resources that have brought in more foreign exchange. For one, the country is a net exporter. The most recent data showed that South Africa’s trade surplus narrowed to about $969 million.

The main catalyst for the GBP/ZAR is the recent UK and South African inflation numbers. On Wednesday, data by the Office of National Statistics showed that the headline inflation rose to 9.1% in May as the cost of energy surged. The same was true in South Africa where the rate of inflation rose to a five-year high of 6.5%. This was the first time in five years that the country’s inflation has moved above the central bank’s target.

Therefore, analysts believe that SARB will continue hiking interest rates at the fastest pace in decades in a bid to lower inflation. Forward estimates show that the bank will hike rates by 60 basis points in July and by 185 bps by December.

The GBPZAR price will next react to the upcoming UK retail sales numbers. Economists expect the data to show that sales tumbled sharply in May as inflation rose. The UK inflation rose to a multi-decade high of 9.1%.

GBP/ZAR forecast

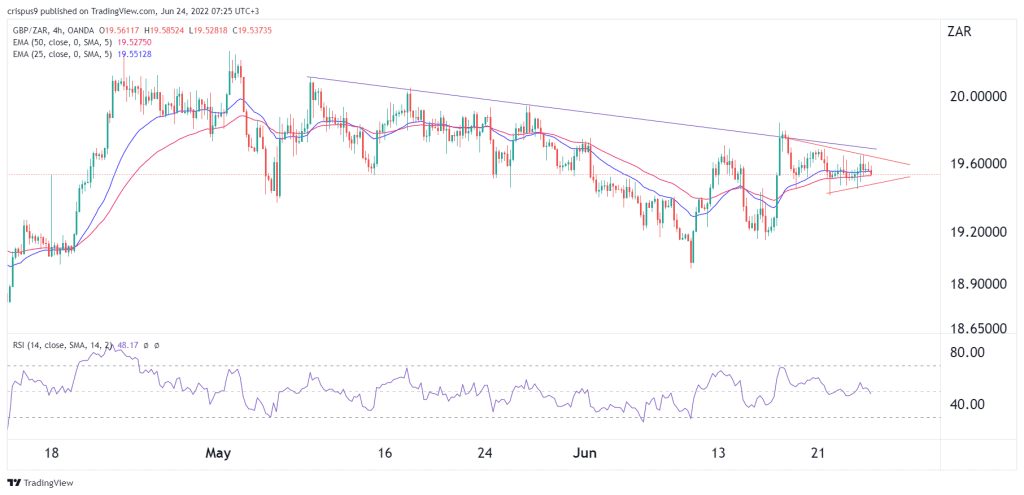

The four-hour chart shows that the GBP/ZAR price has been in a consolidation phase in the past few days. It is trading at 19.54, where it has been in the past few days. This price is along the 25-day and 50-day moving averages while the Relative Strength Index (RSI) has moved sideways at 50. The pair has also formed a triangle pattern that is nearing its confluence level.

Therefore, there is a possibility that the pound to rand price will have a bullish breakout in the coming days. If this happens, the next key level to watch is at 20.0. A drop below the support at 19.45 will invalidate the bullish view.