The GBP/INR pair is trading higher this Tuesday, continuing Monday’s bounce that truncated the downside move that followed the Reserve Bank of India’s interest rate decision. The RBI opted to raise interest rates by 50 bps, beating market expectations.

This move strengthened the Indian Rupee against a British Pound, which took a hit from the gloomy economic forecast of the Bank of England on Thursday soon after UK interest rates went up by 50 bps. The price evolution on the pair has formed a rising wedge pattern.

The pair’s recovery comes as the Indian Rupee weakened following increased bets of additional Fed rate hikes. The US jobs report blew expectations out of the water and provides room for more aggressive rate hikes by the Fed, as the US labour market continues to show resilience despite recession fears. The GBP/INR is up 0.22% and will face a fundamental trigger on Friday when the UK GDP data are released.

GBP/INR Forecast

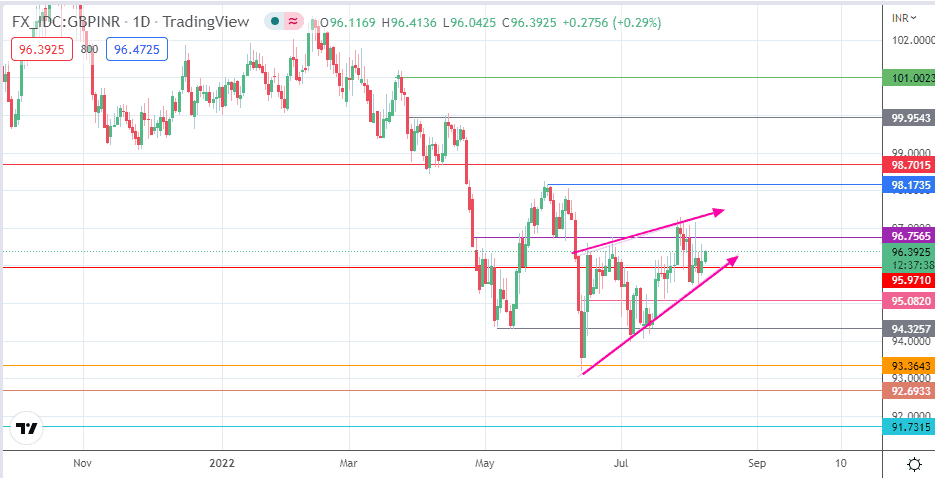

The intraday uptick keeps the rising wedge pattern intact, with the 96.7565 resistance set to form the next target for the bulls. If this resistance is broken, the wedge’s upper border becomes vulnerable. A continuation of this move toward the northern barrier at 98.1735 (30 May high) invalidates the pattern. Above this level, additional resistance targets are found at 98.7015 (8-12 April lows) and at 99.9543 (13 April 2022 high).

On the flip side, the bears need to force a breakdown of the 95.9710 support, where the 29 July low is found. This breakdown move will also degrade the pattern’s lower border, thus completing its evolution. This scenario makes the 94.3257 support (15 July low) the location of the measured move’s completion point.

This move must take out the 95.0820 support mark (21 July low) to attain completion. If there is further price deterioration, the 93.3643 support level, formed by the low of the 14 June candle, assumes a position as the additional harvest point for the bears.

GBP/INR: Daily Chart