The GBP/CHF pair resumed the downward move this Thursday, fuelled by comments from a member of the board of the Bank of England (BoE). A higher-than-expected increase in Switzerland’s consumer price index is also weighing on the pair.

BoE policymaker Catherine Mann set off the selling of the British Pound when she opined that the inflationary risks in the UK would distract businesses from productivity-boosting decisions that needed to be made for the long term. Speaking in a podcast on Thursday, Mann told academics that UK’s high inflation “has many downside consequences”. Mann is a notable BoE hawk who had called for rate hikes well before the Bank of England began its tightening round. This week, Goldman Sachs indicated that elevated natural gas prices could send UK inflation over the 22% mark in 2023 if not modulated.

On another note, Switzerland’s inflation rate on the consumer end rose by 0.3% monthly for August 2022. This was higher than expected, as economists had called for a 0.2% increase. This figure also shows a noticeable jump after inflation had flattened at 0.0% in July. This number means that annualized inflation now stands at 3.5% annually and increases the odds of tightening by the Swiss National Bank.

The GBP/CHF is down 0.3% as of writing, as the fundamentals have weakened the Pound and strengthened the Swissy slightly.

GBP/CHF Forecast

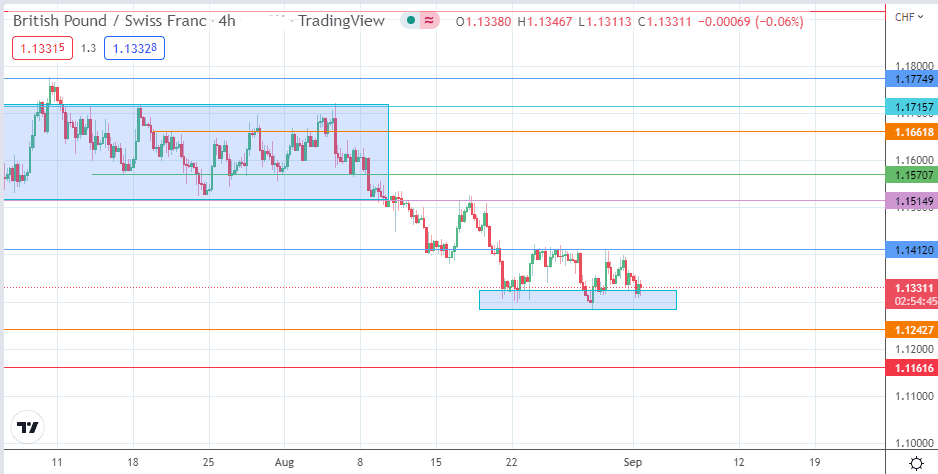

The price action on the pair is just off the demand zone. However, the bulls need to increase the momentum to target the 1.14120 resistance (30 August high). Successful clearance of this price level gives the bulls clear skies to aim for 1.15149 (16 August high). Additional targets at 1.15707 and 1.16618 () become available if the bears fail to defend the resistance at 1.15149. The upper border of the degraded rectangle at 1.17157 and the 8 July high at 1.17749 are additional price targets to the north.

On the flip side, the price action needs to breach the demand zone’s lower border at 1.12826 (29 August 2022 low) to extend the drop toward 1.12427, the site of the 23 March 2020 low. An additional southbound target resides at 1.11616 (18 March 2020 low).

GBP/CHF: Daily Chart