On an Australia day which saw the Australian CPI figure climb from 0.7% to 1.3% (1.0% estimate), translating to an annualized figure of 3.5% (forecast of 3.2%), the GBP/AUD is trading higher as the Reserve Bank of Australia said that consumer inflation in Australia was not at worrying levels.

Central banks use inflation data to determine monetary policy. Therefore, what is traded is the expectation of the apex bank’s response to inflation figures. Even though Australia’s consumer-level inflation figures are rising, as in the rest of the world, the RBA feels it is still at manageable levels. Therefore, its 3-year rate-hiking moratorium stays in place.

The GBP/AUD us up marginally by 0.04% after the bulls forced price up from the daily lows by 95 pips.

GBPAUD Outlook

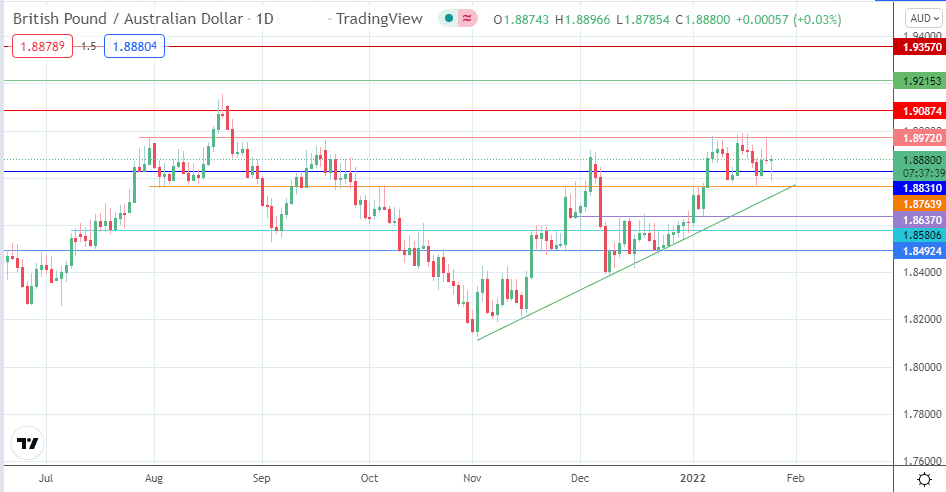

The attempt by the price candle of the day to break the neckline at 1.87639 was rejected, leaving the triple top unconfirmed. A breakdown of this neckline is needed to confirm the pattern. If successful, this opens the door towards the 1.86370 support as the completion point of the measured move. 1.85806 and 1.84924 are additional targets to the south.

On the flip side, a break of 1.89720 following the rejection just above 1.87639 allows the pair to resume the upside move, targeting 1.90874 as the initial upside target. The 20 January 2020 high at 1.92153 serves as an additional northbound target before 1.93570 arrives as a new target down the road.

GBP/AUD: Daily Chart

Follow Eno on Twitter.