The GBP/AUD resumed the slide on Tuesday, falling an additional 65 pips to put the pair on course for a second straight losing session and the eighth day of selling in nine.

Several bearish fundamentals are driving the British Pound lower as the cost of living crisis worsens. The latest round of bearishness was triggered when the Bank of England provided a pessimistic outlook for the UK economy. A string of poor data has since followed, which along with the pressure on UK families from rising food and energy prices, has driven holders of the Pound to the exit door.

The BoE had, at one time, predicted an annualized inflation rate of 10% for 2022. That outlook was revised upward in its last meeting to 13.3%. But the stratospheric increase in food and energy prices that has led the UK energy regulator to predict a tripling of gas prices by 2023 now looks set to drive inflation even higher. Analysts at Goldman Sachs predict that UK inflation in early 2023 could exceed 20% if gas prices do not come down. According to the UK energy sector regulator, Ofgem, UK energy bills could rise 80% in October.

The GBP/AUD is now set for a 3% fall in August, adding more sorrow to the Pound in a horror year that has seen it drop 2,330 pips against the Aussie Dollar in 2022.

GBP/AUD Forecast

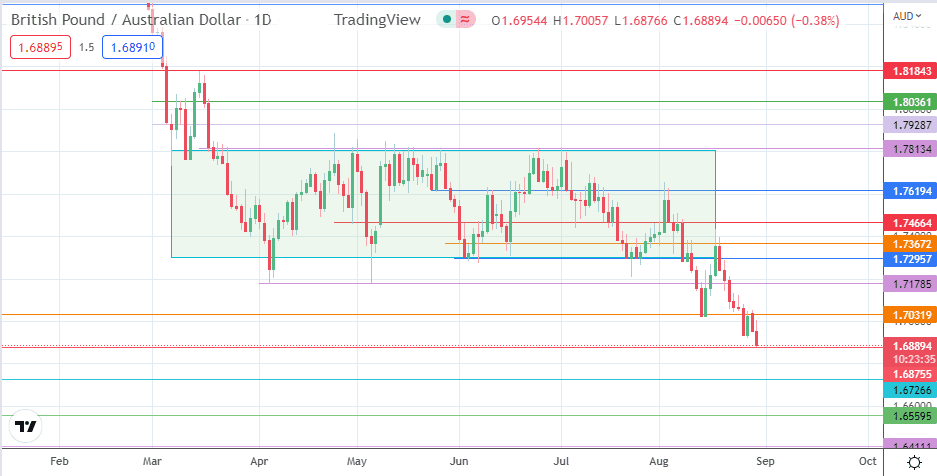

The initial breakdown of the rectangle and rejection of the return move at the 1.73672 and 1.72957 resistance levels have set the tone for a measured move to the south. The intraday decline is testing the support level at 1.68755. The breakdown of the support at 1.68755 (27 September 2016 low and August 2022 low) creates access to the 1.67266 pivot, which houses the prior multi-year lows of 12 August 2016 and 22 June 2017. Below this level, a further descent will make contact with support levels at 1.65595 (28 November 2016 low and 28 March 2017 high) and the 15 November 2016 low at 1.64111.

This outlook is only negated if the bulls resist attempts to degrade 1.68755. Any bounce from this point targets 1.70319 initially (26 August high). The bulls must uncap this barrier before 1.71785 (5 April/5 May lows) becomes a viable target. A further upside retracement will meet opposition at 1.72957 (19 August high), where the degraded rectangle’s lower border is found. In the context of the GBP bearishness, this upside retracement may be seen as a rally that seeks new selling points.

GBP/AUD: Daily Chart